In 1954, UK-based technology company Pye Radio came up with a neat little cost-cutting innovation. In order to avoid the expense that came with collecting cash from the bank, guarding it, checking it and sorting it into individual wage packets, they decided they would pay their (mostly very skilled) workers by cheque.

It did not go well. Employees weren’t keen on having to do the extra work of collecting the cash themselves. Protests were made on the basis that the system contravened the Truck Act of 1831, which forced employers to pay wages in the “current coin of the realm” (rather than in scrip). The labour market was tight at the time; unemployment in the UK was under 2%. Pye went back to cash.

It was another six years until they could try again: the 1960 Payment of Wages Act finally allowed employers to pay wages by cheque, something the banks had long been pushing for (people with cheques often like to have bank accounts).

Take up was slow – so slow, in fact, that John Hunsworth, the secretary of the UK’s Banking Information Service, was driven to hope that there could be a way to make a status symbol out of the depositing of cheques into a bank account.

Once everyone had an account, he hoped employees would begin – as was already the case in the US – being paid fortnightly or monthly instead of each week. Good for the banks and good for employer cash flow. Innovation hasn’t always come fast to the payroll sector.

Workers dont want to live to a monthly budget

In the end it happened as he hoped. And, for the past 40-odd years, nothing has changed. The assumption that being paid monthly into a designated bank account is a correct and sustainable norm is so embedded into payroll thinking that even the recent revamp of the UK’s benefit system insists on benefits being paid monthly.

Welfare recipients, says the state, must learn to budget like workers. But here is the interesting part: it seems that this is not how workers want to budget. And, with the US labour market very tight (unemployment is the lowest since the late-1960s) and the restoring of manufacturing in a tariff-tense world likely to make it more so, that is beginning to matter.

So, what do workers want? They want employers to abandon the idea that payroll timing has to be dominated by a system left over from pen and paper calculation days and to start paying them more flexibly – daily or perhaps after every shift.

Some employers are responding already, particularly at the lower end of the market (where labour is harder to find than at the highly-skilled end). Drivers for the cab-booking app Lyft can be paid the old-fashioned way into a bank account or via Express Pay, which lets them draw down their pay to a debit card every time their accumulated earnings hit $50.

Uber and franchises of McDonald’s, Taco Bell and Wendy’s all offer similar plans and a whole sector of companies providing instant payroll services to employers is popping up to serve the nascent demand.

What works for employees will work for employers too

It makes sense for many workers: if 75% of Americans say they live payday to payday why wouldn’t they want to rip up a system that effectively makes them a creditor to their corporate employers and force those employers to pay them in real time?

It should work for employers too. One company that facilitates such a system claims that those who use it see a 41% reduction in staff turnover and that workers are nearly twice as likely to apply for a job that offers pay on demand. The slogan used by another such business, Instant Financial, sums the idea up as: a “solution to succeeding in the toughest labour market”.

The arguments against catering to workers’ demands in this way mostly come down to admin and expense. Transferring money to bank accounts or to prepaid debit cards costs either employers or employees something. The more often you do it, the more it costs. Lyft workers pay a 50-cent transfer fee when they drawdown, for example – and that’s a relatively low fee. Charges of this kind draw the criticism that pay on demand is no more than a cheaper version of a payday loan.

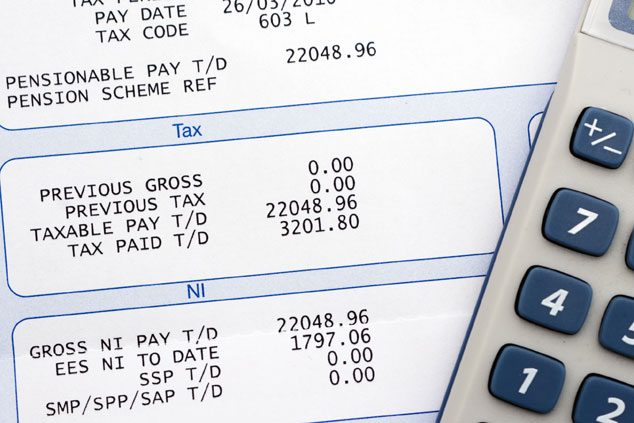

Then there is the fact that companies wanting to internalise the cost via their own payroll (rather than via effective loans from a payment company) usually have to submit data to the relevant tax authorities with each payment. Do that every day instead of every month and you’ll need either better software or a lot more people. Finally, some take the view that allowing workers to draw their earnings as and when they want them will make it harder to budget sensibly.

These objections are all either manageable or irrelevant. The only thing that matters in a period of labour shortage is what a worker requires in order to take, and keep, the job that is offered. So to build a good workforce, employers will have to pay up for the relevant software; cover the extra transfer costs; manage their cash flow; and stop patronising low earners about their money management.

The Pye workers used the labour shortage as leverage to force their employers to pay them their way back in 1954. Today’s workers will probably do the same. What labour wants labour will get.

• This article was first published in the Financial Times