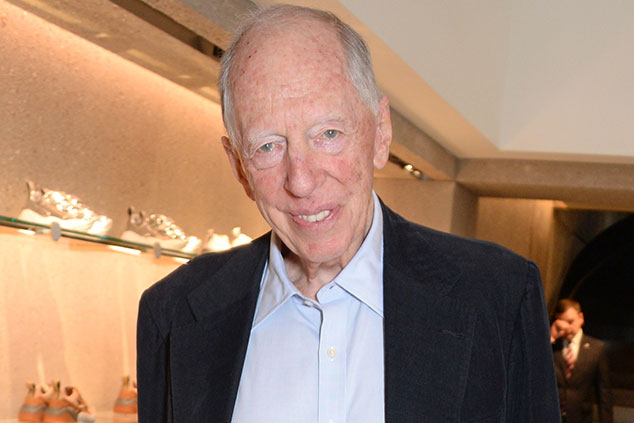

Can firms maintain their currently high levels of profits against this backdrop? Rothschild is sceptical. “The last decade has seen a confluence of factors which have benefited companies’ earnings to an unprecedented extent.” These features, which include the “lower cost of capital, reduced taxes, stagnant wages and the influence of globalisation”, are “unlikely to be sustained”. As a result, Rothschild’s trust is “cautiously positioned”.

“We are seeking to invest in situations that either give us a degree of protection in potentially deteriorating conditions or in areas where structural growth rates are sufficiently high for valuations to hold their own or indeed prosper.” Recent examples of such investments include privately owned US-based logistics firm KeepTruckin’, while South Korean online retailer Coupang “continues to grow strongly”. The trust, which is part of MoneyWeek’s model investment trust portfolio (see here for more about this), returned 10% over the year to 30 June, and 73% over five years.