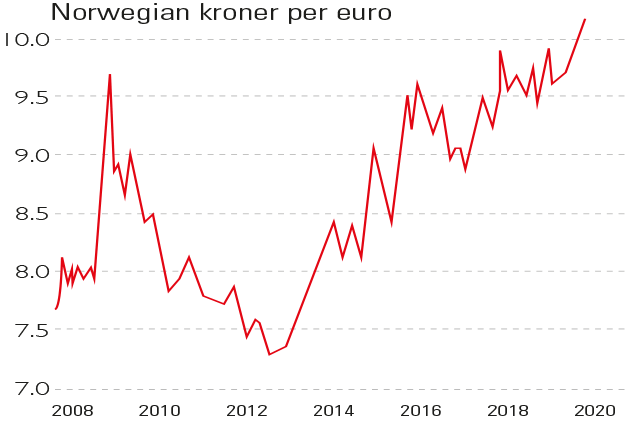

The Norwegian krone has slipped to a record low of more than ten to the euro. It’s not entirely clear why it has done so badly; its 6% loss against the single currency in the past six months is the worst performance of any major currency. Interest rates have actually risen four times and the economy seems robust.

This is partly an oil story. Oil and gas comprise half the country’s exports and oil has weakened recently amid signs of weakening global growth. But the central bank thinks a key change over the past few years is that in times of heightened uncertainty, especially during a trade war, investors are increasingly turning away from the currencies of small, open economies.

Viewpoint

“Deficit doomsaying has fallen out of fashion and yesterday’s advocates of austerity are now spending like drunken sailors on… shore leave. This swapping of hair shirts for Hermès has been particularly pronounced in the US, where the federal deficit has swollen dramatically. This raises the question of who is prepared to pay for this profligacy and the answer is, of course, all of us (it is a task well beyond the resources of America alone). The nattering nabobs of negativity fret that foreigners may lose their taste for US government paper, prompting a surge in Treasury yields, a collapse in the US dollar and the end of civilisation as we know it…. but there is little sign of this… foreign holdings of US Treasuries hit an all-time high in August. The Chinese may be scaling back their exposure, but other countries, including Japan (the largest foreign holder of this paper) are happy to step up.”

Jonathan Allum, The Blah