In today’s Money Morning we bang a drum we have been banging for some time.

We make the case that the Great British pound is undervalued.

We argue that the lows came earlier this year.

And we suggest that now sterling is in a bull market.

Not only is it in a bull market – it’s in a stealth bull market, the best kind of bull market, one that few are talking about…

The stars are coming into alignment for the pound

As you have almost certainly noticed, it is Budget week. My recent experience of Budget announcements is that they do not affect sterling nearly as much as announcements from the Bank of England, so I’m not unduly worried – at least as far as sterling is concerned – about any utterances which are about to escape from chancellor Philip Hammond’s mouth.

The trend is up. Trends are powerful things.

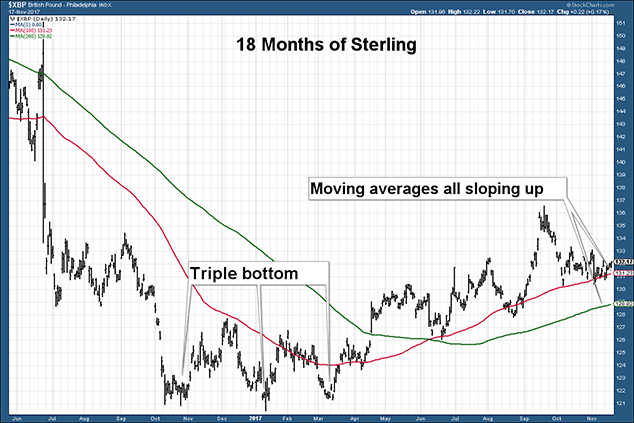

Let me now back this up with a recap of the past 18 months or so.

The first major sell-off in sterling came with the Brexit vote in June 2016, which surprised the foreign exchange markets perhaps more than anyone. That took sterling from the $1.50 area down to the $1.30s.

We then got a second sell-off in September, following the Bank of England’s (unnecessary) decision to slash rates and introduce more quantitative easing (QE). This continued into October, ending with Theresa May’s infamous Conservative Party conference speech and the “Flash Crash”. Intraday extremities aside, the low was about $1.20.

That low was then re-tested in January. And again in March. It held. We have what is known in the tea-leaf trade as a “triple bottom”.

Since that March low – one that I’m pleased to say I nailed here (I don’t get them all right, not by a long shot, so allow me to brag when I do) – sterling has been creeping up. It went as high as $1.36 in September, pulled back to $1.30 and is now creeping up again. The current price is $1.32.

Sterling is now trading above its 100- and 200-day simple moving averages. Both are all sloping up, in, again falling back on tea-leaf terminology, “golden alignment”. At the recent pullback, the 100-day moving average (the intermediate-term trend) held. This is the kind of action you want to see.

It’s not just the charts that say sterling is cheap

So that’s the hocus pocus technical view of things. But on a simple valuation basis sterling is cheap too.

Charles Ekins, CIO at research and investment management boutique, Ekins Guinness, measures sterling against various other currencies on a purchasing power parity (PPP) basis.

This is the simple “basket of goods and services” approach – how much does your money buy you? The more it buys you, the more fully valued your currency is. The less it buys you, the more undervalued.

In Ekins’ chart below, the blue line shows the price of sterling. The red line shows where it “should” be – ie, fair value on a PPP basis. $1.60, Ekins calculates.

Similarly, €1.20, as opposed to the current price of €1.12, is fair value against the euro, says Ekins.

I should say, by the way, that from a technical point of view, sterling is not in a clear uptrend against the euro in the way that it is against the US dollar.

Looking cursorily at some of the other currencies. Against the Japanese yen, the uptrend is clearer, but the PPP valuation is more neutral. So sterling is perhaps not such a compelling buy.

But against the commodity currencies – the Aussie dollar and the Canadian dollar – there is a similarly compelling argument as with the US dollar. Sterling is in an uptrend, and is undervalued on a PPP basis. Against the Aussie dollar, Ekins estimates PPP at more than AU$2.20, compared to the current price of AU$1.73. It is, in other words, very cheap.

Are you ready for a Frisby Flux?

Finally, I would like to draw your attention to something I have mentioned before: Frisby’s Flux.

There seems to be, for some unknown reason, an eight-year cycle in the pound. I dubbed it Frisby’s Flux as I was, to my knowledge, the first to write about it, and I want more acclaim than I’m currently getting.

Anyway, every eight years sterling experiences a sell-off, often accompanied by some political event, after which it rebounds.

In 1976, the then-chancellor, Dennis Healey, had to go begging to the International Monetary Fund (IMF). In 1984, there was the aftermath of the miners’ strike and the extraordinarily high value of the US dollar against all currencies, ending with the concerted international effort to bring its price down with the Plaza Accord.

Eight years later in 1992, there was the infamous Black Wednesday, when the government had to withdraw sterling from the European Exchange Rate Mechanism. A sell-off also followed the dotcom crash eight years later in 2000. And in 2008, during the Global Financial Crisis, sterling took another hammering.

You never know with cycles theories if it’s just coincidence – but this one is pretty compelling.

On the basis of this cycle, you want to be long sterling until around 2022, at which point you start looking for a shorting opportunity with an eventual low around 2024-25.

So there you are, a mixture of long-term cycles, trend analysis and simple valuation metrics lead me to believe sterling is a compelling buy. Let’s see where we are in three months.