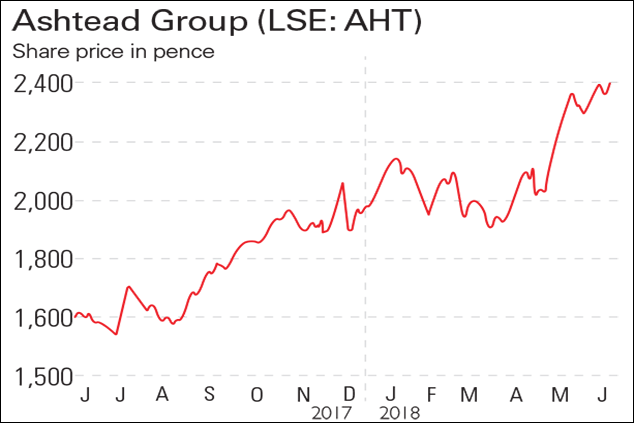

Ashtead Group (LSE: AHT) rents out construction and industrial equipment. Over the past decade, its shares have risen by almost 2,700%. A combination of a building boom and hurricanes in the US has driven demand for Ashtead’s rental equipment, which has boosted profits and revenues. Over the past five years, revenue has increased from £1.1bn to £3.2bn, a compound annual growth rate (CAGR) of 23%. During the same period, net profit climbed from £89m to £501m, a CAGR of 41%. For the first nine months of this year, rental revenue increased by 21%.

Be glad you didn’t buy…

Esure Group (LSE: ESUR) provides insurance services in the UK. Its share price briefly plunged in September following reports that founder Peter Wood was trying to sell his controlling stake in the firm, currently 30.7%. In March, Esure reported a better-than-expected 35.6% increase in full-year profit before tax, driven by a rise in demand for motor insurance products. Its gross written premiums also rose by 25.2% to £820.2m. Shares rallied. However, the home-insurance division saw declines, and last month Esure warned about increasing competition.