Quick thing before I get started today – if you’re going to be in Edinburgh next month and you fancy seeing Merryn Somerset Webb live on stage talking about everything from populism to economics to Brexit to Trump to Adam Smith, then book your tickets now (she’s there from August 16th to 25th) before they sell out.

If you missed any of this week’s Money Mornings, here are the links you need.

Monday: When Ben Bernanke says “don’t worry”, smart investors get nervous

Tuesday: This may be the best defence against escalating currency wars

Wednesday: Bitcoin’s big bounceback – can it continue?

Thursday: Are investors finally fed up with Facebook?

Friday: How China’s shifting monetary policy could fuel a final surge for global markets

Other things you shouldn’t miss this week: Merryn follows up from last week’s blog on Britain’s productivity puzzle and explains why it’s largely down to a glut of cheap labour from the EU and the introduction of the tax credit system (another thing to thank our old nemesis, Gordon Brown, for).

In the podcast this week, Merryn and I talked a bit more about productivity; had a chat about the yield curve, what it is, and why you have to worry if it turns down; and Merryn told us all about why she’s commandeering Adam Smith’s only surviving house for a fortnight during the Edinburgh Fringe Festival – and book your tickets now (she’s there from August 16th to 25th) before they sell out.. Have a listen here.

There were a couple of overriding themes shaping the market this week – on the one hand trade tensions eased (between the EU and the US at least) and people are starting to think that China will ease monetary policy, but on the other, Facebook hit a wall of consequences that will take at least some of the steam out of the FANG tech stocks.

We might start to see a full-on regime change in the market. Is this where value starts to claw back some of the vast swathe of ground lost to growth in recent decades?

There were also some intriguing moves in the Japanese government bond market, which we’ll get to in a moment.

Now over to this week’s charts.

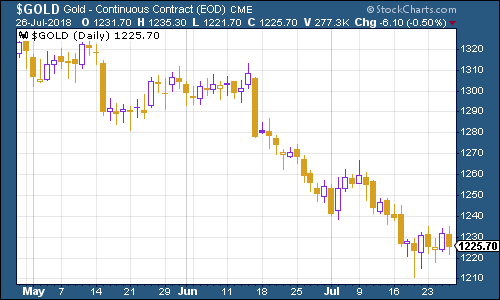

Gold which This may be the best defence against escalating currency wars, hasn’t done much. It’s out of favour, holders are disillusioned, and investors are more interested in risk assets right now. It’ll be becalmed or falling until the investment story changes – which it will, as it always does. In any case, it’s worth holding some in your portfolio as insurance.

(Gold: three months)

The US dollar index – a measure of the strength of the dollar against a basket of the currencies of its major trading partners – is hard to keep down, as Donald Trump is discovering. And no wonder. If China is trying to loosen monetary policy, the Bank of Japan is sticking to its own guns, and Europe also wants to keep rates low for the foreseeable future – the dollar has no real competition.

(DXY: three months)

Turning to bond yields, and what we were discussing earlier – the most newsworthy movement was not in one of our regular charts, but in the Japanese ten-year bond yield, as you can see below.

Basically, investors are starting to believe that the Bank of Japan is planning to shift tack on monetary policy. At the moment, the BoJ has said that it wants to keep the yield on the ten-year Japanese government bond sitting at 0%, or thereabouts, and has also essentially said that it will print as much money as it takes to buy more bonds if they go above 0.1%.

It’s tricky though. By keeping rates at this level, it’s hard for banks to make profits (they benefit from a steeper yield curve – and there’s more on here if you’re wondering exactly what that is). And that’s not really what the BoJ intended. I mean, if you want to encourage inflation in your economy, the banks are among the best places to start, because they’re the ones who dish out credit.

In a way, this is a similar situation to when Britain left the European Exchange Rate Mechanism – the markets can see that the situation is unsustainable, and they are starting to call the bluff of the central bank in charge of enforcing it.

We’ll see what the eventual outcome is, but I suspect the BoJ will change its policy sooner rather than later. The risk then is that the yen will strengthen, but I’m sure that they can find ways to handle that.

(Ten-year Japanese government bond yield: three months)

The yield on the ten-year US Treasury bond perked up this week too as investors started to worry less about inverting yield curves and decided to buy risk again.

(Ten-year US Treasury yield: three months)

The yield on the ten-year German bund (the borrowing cost of Germany’s government, which is Europe’s “risk-free” rate) also followed the US higher.

(Ten-year bund yield: three months)

Copper rallied a bit this week. It’s probably partly about looser monetary policy in China and also about more threats of strike action at BHP’s giant Chilean copper mine, Escondida.

(Copper: three months)

Bitcoin’s big bounceback – can it continue?It’s been onwards and upwards for the original cryptocurrency for the last month or so – which oddly enough, appears to coincide with China loosening its monetary policy.

(Bitcoin: three months)

On US employment, the four-week moving average of weekly US jobless claims fell slightly to 218,000 this week, while weekly claims rose from a near-50-year low to 217,000.

David Rosenberg of Gluskin Sheff notes that, in the past, when US jobless claims hit a “cyclical trough” (as measured by the four-week moving average), then a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later.

We hit a new trough – of 213,500 – about two months ago, so if there’s anything to Rosenberg’s observations (which are of course drawn from a limited pool of past cycles), then we should see the stockmarket hit new highs before this cycle is out, and so far that’s already happened with the Nasdaq index.

Clearly, it’s also possible that we could well see a fresh trough in the near future.

(US jobless claims, four-week moving average: since January 2016)

The oil price (as measured by Brent crude, the international/European benchmark) is perking up again. As my colleague Matthew Partridge wrote in last week’s issue of MoneyWeek magazine, the oil sector is looking good for now.

(Brent crude oil: three months)

Internet giant Amazon slipped back from recent highs, arguably taking a bit of collateral damage from Facebook’s massive slump.

(Amazon: three months)

Electric car group Tesla headed lower as investors continue to worry over whether the company can get its act together or whether it will run out of willing investors first. They may also be wondering about how Elon Musk has so much time to spend on Twitter getting into arguments with critics instead of sorting out the company’s issues.

(Tesla: three months)