After a lengthy drought we have not one but two podcasts for you this week. First, Merryn and I give our take on the election result. You’ll not be surprised to know that we think it’s good news for investors and the UK economy. But what about the prospects for Scottish independence? And the future for the Labour party? And the pound? Listen here – and don’t forget to send us your hate mail.

Secondly, I joined the team at The Week Unwrapped for their latest podcast. I talked about the Saudi Aramco listing and what it means for oil and geopolitics, while The Week team talked about psychopathy and the proliferation of privilege in the acting profession. I spend a lot of this one in a state of mildly baffled cynicism but it was fun to do.

Meanwhile, if you missed any of this week’s Money Morning articles or blogs, here are the links you need:

Monday: Investors today are unreasonably bearish on oil companies

Tuesday: How to plan for the general election result

Wednesday: Why traders should believe in Santa Claus

Thursday: It’s inflation or bust as far as the Federal Reserve is concerned

Friday: Why the Conservative victory is good news for investors

Currency Corner:

Merryn’s Blog: Six contrarian books for Christmas

Subscribe: Get your first 12 issues of MoneyWeek for £12

This is where I normally plug my book, The Sceptical Investor, but I’ve just found out that the publisher Harriman House are going to do a 40% off deal on it for a few weeks immediately after Christmas, so much as it goes against the grain to tell you to hang on, you probably should!

(Although if you want to get the audiobook version then I think you can get that free if you sign up to Audible at the same time – here’s the link!)

The charts that matter

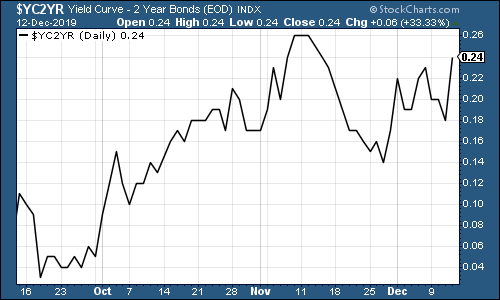

The yield curve

has widened slightly again this week – that is, the gap between the yield on the ten-year US government bond and that on the two year has expanded, which is what you’d expect in a healthy economy.

That said, the curve inverted in August this year (in other words, the two yielded more than the ten) which history suggests means a recession is likely to within 18-24 months from then (in other words, by August 2021). No indicator always gets it right, but the yield curve does have a good track record.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

Gold (measured in dollar terms) fell this week. I’d mostly put this down to the return of a more “risk-on” attitude towards the end of the week, driven primarily by Donald Trump’s teasing of a US-China trade deal, but also by the lifting of a certain amount of uncertainty over Brexit, following the decisive British election outcome.

(Gold: three months)

The US dollar index – a measure of the strength of the dollar against a basket of the currencies of its major trading partners – also weakened further this week, which is also conducive to a “risk-on” mood. It was helped by the Federal Reserve’s latest meeting, at which the US central bank made it clear that it was in no hurry to raise interest rates.

(DXY: three months)

The number of Chinese yuan (or renminbi) to the US dollar (USDCNY) slipped closer to the key seven mark, which is again, a “risk-on” sign – when the dollar is strengthening (the line on the chart below is rising), that’s deflationary; when the yuan is strengthening (the line is falling), that’s inflationary.

(Chinese yuan to the US dollar: since 25 June 2019)

The ten-year yield on US government bonds ticked higher again – when markets are in “risk-on” mood, bond prices tend to fall (and so yields rise).

(Ten-year US Treasury yield: three months)

The yield on the Japanese ten-year is tantalisingly close to positive territory.

(Ten-year Japanese government bond yield: three months)

The yield on the ten-year German bund is rising too, helped by signs that the global manufacturing cycle may have started to bottom out.

(Ten-year Bund yield: six months)

One very promising sign came from copper this week. A possible trade deal, signs of a pick up in the Chinese economy, a weaker dollar – no wonder copper moved higher.

(Copper: six months)

The Aussie dollar followed suit, strengthening against the US dollar.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin appears to have gone back into one of its hibernation phases.

(Bitcoin: ten days)

US weekly jobless claims leaped to their highest level in more than two years this week, jumping to 252,000, much worse than expected, and up from 203,000 last week. The four-week moving average jumped to 224,000.

The figures are thought to be distorted by Thanksgiving – last week was surprisingly low, this week surprisingly high. So maybe it’ll fall next time.

But I have to say, if this was a share price chart, I’d say it was at risk of breaking out. That would indicate that a market top is likely on the way, with a recession not all that far behind.

That said, you could have said the same thing towards the end of 2018, and you’d have been wrong. Let’s see what happens over the next couple of months.

(US jobless claims, four-week moving average: since January 2016)

The oil price (as measured by Brent crude, the international/European benchmark) continues to meander higher. Oil cartel Opec agreed further cuts to oil production, and Saudi Arabia is keen to prop up the valuation of the recently-listed oil company, Saudi Aramco. If global demand picks up more rapidly than investors expect, I suspect that next year’s big surprise could be a sharp rally in oil prices.

(Brent crude oil: three months)

Shares in internet giant Amazon rose a little this week as the market started to rally on hopes of a deal between the US and China, and also because of the Fed’s relaxed tone on Wednesday.

(Amazon: three months)

Shares in electric car group Tesla header higher, helped by the fact that chief executive Elon Musk is currently managing to stay out of trouble.

(Tesla: three months)