“Ready for an end-of-year rally?” asks The Sunday Times. Key indices in America, Europe and Britain had gained 20% from their late October lows by last week before falling back. Bulls note that US stocks, which set the tone for world markets, often bounce after an election. The S&P has gained an average of 7% in the three months after a Democrat wins and almost 14% a year later, notes The Sunday Times’s Jennifer Hill. Meanwhile, Morgan Stanley’s European strategist Teun Draaisma, who rightly warned investors to sell in June last year, reckons that while there are short-term risks ahead, “the severe part of the bear market is over”.

It’s hard to share this confidence. Even after last week’s surge, major indices remained in a downtrend, as John Authers points out in the FT. They hadn’t risen above their 50-day moving average, a key indicator of the longer-term trend. And when US elections take place in bear markets, as Alan Abelson points out in Barron’s, the S&P slides by an average of 6% by the end of the year.

But the overriding issue at present is that investors are still getting to grips with the rapidly deteriorating global economic outlook. The IMF is now forecasting that the developed world faces its first annual contraction since 1945. This is hardly a typical recession that may be over within a year, but a case of huge credit and housing bubbles bursting. “The unwinding of the massive economic and financial imbalances built up over the past decade requires a long and painful hangover,” says Capital Economics.

Interest-rate cuts have had scant impact on the economy or the markets this time as the money markets are gummed up, rattled banks are shrinking their balance sheets and savings-short consumers are in no mood to take on more debt. So statistics that say stocks should soon embark on a bull trend because they tend to bottom out months ahead of the end of a recession are of no help – partly because we don’t know how long the recession will last. So beware of “geeks bearing recovery data”, says John Mauldin on Investorsinsight.com.

No wonder global market confidence has been dented over the past few days by corporate news showing that the recession is deepening and the impact of tighter credit on the world economy “will continue to reverberate”, says UBS. American electronics retailer Circuit City has filed for bankruptcy after a clampdown on credit-card lending dented sales and its suppliers had withdrawn credit lines and insisted they be paid upfront. Weaker British retailers are also being squeezed by suppliers, says David Wighton in The Times. American mortgage giant Fannie Mae has posted a $29bn third-quarter loss as the housing downturn continues; the Fed extended its rescue package for insurance giant AIG; while in Britain, Intercontinental Hotels’ poor earnings outlook rattled investors.

So bad news is still unnerving the markets, casting doubt on whether the worst has really been factored in. With earnings estimates for next year still high and the economic downturn in its early stages, there are plenty more profit downgrades to come – and stocks don’t do well in times of slowing earnings momentum, says Peter Jarvis of F&C Asset Management. An improving American housing market and a return to normality in the credit market would be needed for a sustained rebound, he reckons. These are some way off: in October, US credit-card issuers were unable to sell a single bond (backed by credit-card debt). The damage caused by the unwinding “supercycle of debt”, as Albert Edwards of Société Générale puts it, is far from over, and cheap stocks thus look set to get even cheaper. In the words of Michael Pento of Delta Global Advisors, “these are not normal times”.

The big picture

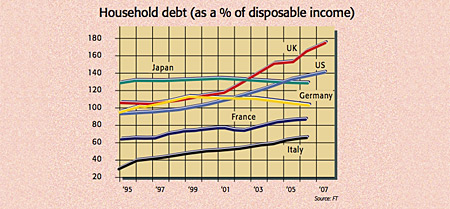

This chart highlights why the recession is set to be worst in the big Anglophone economies. Encouraged by rocketing house prices, consumers in America and Britain loaded up on credit and ran down their savings to historic lows. Now that the housing bubbles have burst and credit has tightened, households are having to rebuild savings, implying sharply lower consumption (the lion’s share of the economy) and growth. Germany, with no burst property bubble, less household debt and higher savings, should suffer less in the credit crunch-induced downturn and is better placed for recovery.