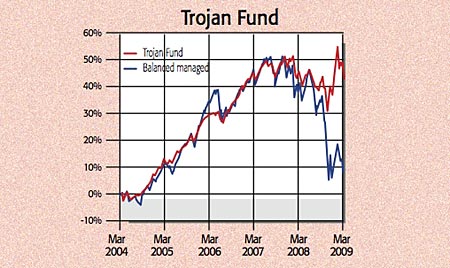

Sometimes it pays to be bearish. Convinced that the debt-fuelled boom couldn’t last, Sebastian Lyon hasn’t held a bank in his £198m fund, the Troy Asset Management Trojan fund, for more than five years. Indeed, up until recently, as little as 25% was invested in equities. “We saw the 2003 to 2007 move in the markets as a bear-market rally,” says Francis Brooke, a director at Troy. It was a good move. The fund rose 1.1% in 2008, against a 29.9% drop for the FTSE All-Share.

Given this sceptical outlook on stocks, it’s notable that by the end of last year, 69% of the fund was invested in them. “If you look at the return on equities over the last four decades, the huge premium built up in the 1990s has now been eroded.” Stocks look quite reasonably valued when compared to cash and other assets, says Lyon, with big consumer and energy stocks, such as Tesco, Centrica and National Grid, the most likely to rally when the market does. “We don’t buy mid-cap or recovery stocks.”

The fund can skip between equities and other asset classes as it sees fit so it isn’t limited to following its favourite themes. Chief among them is gold, which the fund has held for four years. Just over 8% of the fund is invested in a gold exchange-traded fund, Gold Bullion Securities, which is physically backed by the metal. Despite its recent highs, Brooke says it still looks attractive – particularly as, with interest rates scraping 0%, the opportunity cost of holding gold rather than getting interest on cash has fallen sharply.

Contact: 020-7499 4030.

Troy Asset Management Trojan fund’s top ten holdings

| Name of holding | % of assets |

|---|---|

| Lyxor Gold Bullion | 8.01 |

| BP | 5.12 |

| Royal Dutch Shell B Ord | 4.53 |

| Alliance Trust Plc |

4.34 |

| British American Tobacco | 3.85 |

| Reynolds American Inc | 3.86 |

| Centrica | 3.37 |

| Johnson & Johnson | 3.38 |

| Tesco | 2.49 |

| National Grid | 2.20 |