The news is about as bleak as it can get and has “Depression” written all over it. The IMF last week when lowering its forecast for global growth this year from a tiny positive number to a negative one, said that it will be the first time since 1945 that the global economy has contracted and that we are in a “Great Recession” – a term that sounds like they are trying to avoid using the word “Depression” but realise the word recession on its own just doesn’t do it.

As we have said before, it is all about the news being in the market or not being in the market; the particular news that we are talking about is unilateral retrenchment. Companies’ and consumers’ abandonment of the bad habits of borrowing and spending and a returning to saving and paying down debt.

Richard Koo, in his book The Holy Grail of Macroeconomics – Lessons from Japan’s Great Recession – gives us two things – a number of important insights and also the probable source of IMF’s latest terminology. If the IMF believe that the world is embarking upon a Japanese style Great Recession, God help us! Although we think they are probably right. In his book, Koo talks about unilateral retrenchment, because it’s what occurred in Japan, but he puts it differently, he uses the correct term which is a “fallacy of composition”, explaining as follows: “When a nationwide plunge in asset prices eviscerates asset values leaving only debt behind, the private sector begins paying down debt en masse. As a result, the broader economy experiences something economists call “a fallacy of composition”. This occurs when behaviour that would be right for one person (or company) leads to an undesirable outcome when engaged in by all persons (or companies).”

Is the fact that we are embroiled in a “fallacy of composition” in the market? – we don’t think so!

The news does not need to be read in detail, it’s enough to know the following:

• Companies are unilaterally cutting back, cancelling capital investment and unnecessary expenditure – as a consequence, other companies’ earnings are collapsing.

• Companies are freezing wages and/or cutting back staff.

• Companies are cancelling or slashing dividends on a scale that Standard & Poor’s says has not been seen since 1938.

• Private consumers have entered a period of austerity.

Governments around the world expect banks to lift their lending hoping that will cause the economy to stop shrinking and start growing. The truth of the matter is that it’s not as simple as that. The reason being that much of the lending that banks are refusing concerns the renewing of excessive lending facilities that were originally made in a different and sloppy world of maniacal credit expansion. Jeremy Grantham, in the FT, said this:

“Now the tide has gone out, $50 trillion of perceived wealth in the US (stock and real estate) has fallen to below $30 trillion, leaving a critical £25 trillion of debt stranded … Bankers today want more, not less, cover.” That’s one side of the story. The other is that those companies that are a good credit risk, and to whom banks would be willing to lend, find the risks of taking on extra debt totally unattractive when the most important thing for them to do is to survive.

As Richard Koo, in his book about Japan, explains:

“Even though interest rates went to zero in Japan, companies were unwilling to borrow but instead rigorously paid down their debt because, technically, they were insolvent – the assets on their balance sheets having lost value and the debt having remained rock solid.”

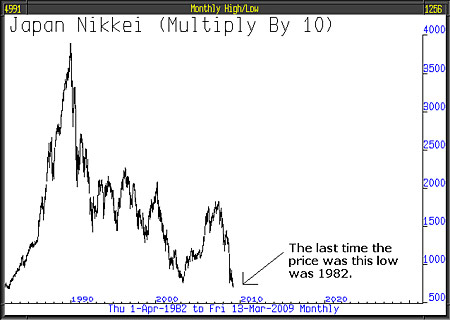

There are cycles in everything and the cycle of excessive borrowing and spending is inevitably followed by an austere cycle of saving and paying down debt. That’s where the world is and it won’t change any time soon. For that reason, it is embarked upon a Great Recession similar to that suffered by Japan; except Japan were lucky, they are a magnificent exporting nation and in the 1990s there was a buoyant global economy to export into, that doesn’t apply today.

It’s hard to be optimistic. We come back to question we asked earlier is the fallacy of composition in the market? We would say certainly not and the bear market won’t end until it is. So stock markets, on that basis, still have a long way to fall.

• This article was written by Full Circle Asset Management, as published in the threesixty Newsletter on 13 March 2009.