Gordon Brown made his crucial speech to the Labour Party conference standing in front of the words ‘Securing Britain’s economic recovery’. But the latest batch of data shows what an uphill struggle that will be. In August, house prices edged down for the first time since April, according to the Land Registry, while mortgage approvals also slid.

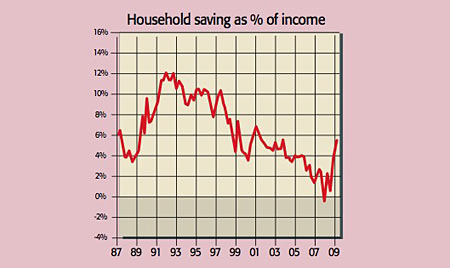

It seems the Bank of England’s quantitative easing (QE) policy is not gaining traction, according to its preferred measure of money supply growth. Households repaid unsecured debt for the second month running in August, while the household saving rate has hit a six-year high of 5.6% of income. Meanwhile, the government announced a £100m extension to the car scrappage scheme.

What the commentators said

It’s not just on the “esoteric” money supply figure that QE “might be judged to be failing”, said David Prosser in The Independent. The hope was that the cash would bolster bank lending, yet the latest figures for consumers and businesses reveal “there is some way to go”.

Nor can we count on consumption – 65% of the economy – to power the recovery, noted Capital Economics. The savings rate is still below its long-run average of 8%, having hit double digits in previous recessions. With debt at record levels, access to credit constrained, and job insecurity mounting, households will continue fixing their finances. Looming tax rises also bode ill for the high street. Consumer spending, now 3.6% down on a year ago, is likely “to remain subdued for some time”, said Asda’s Andy Clarke.

And the extension of the scrappage scheme merely shows the government isn’t confident that the economy is ready to stand on its own two feet. Not that this scheme will help. As David Wighton pointed out in The Times, most of the cars bought so far have been imported smaller models, so there hasn’t been much of a boost to the British car industry.

In any case, the scheme is “merely bringing forward sales” that would have been made later. In France, the end of a scrappage scheme in the mid-1990s led to a 20% plunge in car sales, said Prosser. The scheme does nothing to change the fact that the economy, as the FT put it, is not set for a strong rebound, but is merely “limping towards recovery”.