When interest rates are at record lows and real cash returns after inflation are negative, then there is a powerful temptation for investors to raid their piggy banks and sink the lot into high-yielding equities. This may seem sensible – but it is fraught with danger.

Chasing yield has become a crowded trade. Many dividend stocks are now overvalued. For example, on a three-year time horizon, what an investor may earn in income could be more than offset in capital losses. Worse still, if the payouts are based on conditions staying benign (eg, Libor – see page 48 – at less than 1%), then there is a potential double whammy of dividend cuts further down the line.

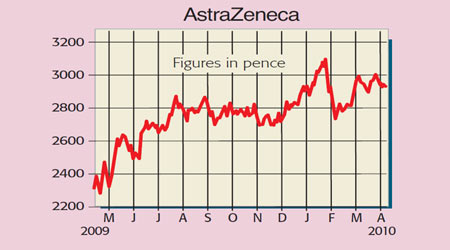

What does this mean for AstraZeneca? I advised buying the healthcare stock at £20.60 in February 2008, based on the long-term attractions of ageing populations, growth in emerging markets and continued medical advances.

The firm specialises in cancer, cardiovascular, gastrointestinal, infection, neuroscience and respiratory treatments, and has a substantial presence in biologics. From a first look at its 2009 figures, unsuspecting punters might rate it as a clear buy. The shares yield a juicy 5%, trade on a paltry p/e ratio of 7.2 and offer downside protection against further sterling declines, given the group’s

overseas exposure.

AstraZeneca (LSE: AZN), rated a BUY by RBS

But don’t be fooled. AstraZeneca is about to hit a looming $16bn patent cliff. More than 50% of its turnover, including its four biggest franchises – Nexium (stomach ulcers), Crestor (cholesterol), Symbicort (asthma) and Seroquel (schizophrenia) – will have come off patent by the end of 2014. And because these prescription medicines generate lucrative margins, I suspect more than 75% of the organisation’s operating profits (Ebita) could bite the dust too.

The group is trying to replace these lost revenues by launching new treatments as fast as possible via a combination of aggressive in-licensing deals and in-house research and development. Yet the hole is so wide that I don’t believe the shortfall will be filled in time. If you wind the clock forward five years – assuming that a powerful tailwind of new compounds are discovered, producing organic growth of, say, 10% a year (or twice global GDP) – then I would still only estimate 2015 sales and underlying EPS at $28bn and $4 per share respectively. On this basis – using a 14-times earnings multiple and discounting back at 10% – the shares are worth around £22.50 each, or 23% below today’s levels.

So if one bought the stock now and held for five years, the total equity return (assuming the dividend remained flat) wouldn’t be much better than zero, or around –10% in real terms. I’d take profits now and either recycle the proceeds into better opportunities, or keep the cash fluid and await another correction. There’s a slim chance AstraZeneca could fall prey to a larger rival (such as Novartis), but for me, at these levels, the numbers for a takeover simply wouldn’t stack up. First-quarter results are due out on 29 April.

Recommendation: SELL at £29.20

• Paul Hill also writes a weekly share-tipping newsletter, Precision Guided Investments