Europe may be in a mess, with debt piling up across the continent. But the same can’t be said of Asia. A large part of the region has sound financial systems and “balance sheets are strong at governmental, corporate and personal levels”, says Meera Patel of Hargreaves Lansdown.

So this week’s fund is the Aberdeen Asia Pacific Fund, which has been run by Hugh Young since its launch in 2006. Young joined Aberdeen’s Asian equities department in 1985 and co-founded the Singapore-based Aberdeen Asia in 1992. So he has plenty of experience in the region.

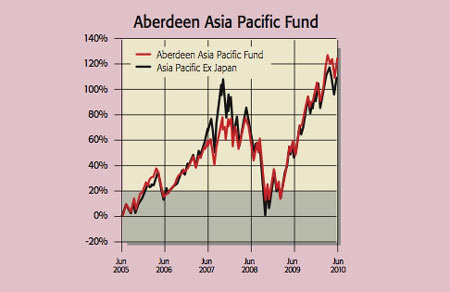

With this particular fund, Young aims for capital growth by investing in Asia Pacific countries other than Japan. And it’s a strategy he executes rather well – the fund has returned 121% over the last five years. That beats the Asia Pacific Excluding Japan index, which returned 106% over the same period.

Young believes China has great growth potential, but he likes to access that growth through Hong Kong or Singapore-listed companies, as they are less risky. A current favourite is Singapore-listed Oversea-Chinese Banking Corporation. The bank has stuck to its core business of providing loans and offers a fairly steady dividend yield, while continuing to expand geographically. By contrast, he recently sold Hong Kong-based clothes retailer Giordano due to fears over its long-term prospects.

“Young and his team have shown time and again that they can generate superior returns, even in an uncertain environment,” says Patel.

Contact: 0845 300 2890.

Aberdeen Asia Pacific Fund top ten holdings

| Name of holding | % of assets |

|---|---|

| Aberdeen Global – Indian Equity Fund | 4.7 |

| Oversea-Chinese Banking Corp | 4.2 |

| Standard Chartered | 3.9 |

| Samsung Electronics | 3.9 |

| Rio Tinto | 3.9 |

| Jardine Strategic Holdings | 3.8 |

| QBE Insurance Group | 3.6 |

| United Overseas Bank | 3.3 |

| Singapore Telecomunications | 3.1 |

| Singapore Technologies Engineering | 3.1 |