“For once”, the event lived up to expectations, said Economist.com. Chancellor George Osborne delivered his long-awaited ‘axe and tax’ budget this week. He announced the biggest fiscal squeeze since the 1930s – 6.3% of GDP by 2014-2015. The aim is to shrink the state, which now accounts for almost half of the economy, and get public debt under control. About 77% of the adjustment will comprise spending cuts, the rest tax hikes.

The budget included a hike in VAT to 20% from January 2011, raising £12bn next year. Capital-gains tax has risen from 18% to 28% for higher-rate taxpayers. Banks will pay a tax on their assets, expected to raise £2bn a year. Corporation tax will fall by 1% a year over the next four years, taking it to 24%, among the lowest rates in the G20. Osborne also launched a clampdown on welfare spending, which accounts for 28% of overall expenditure. This included capping housing benefit and freezing child benefit for three years.

What the commentators said

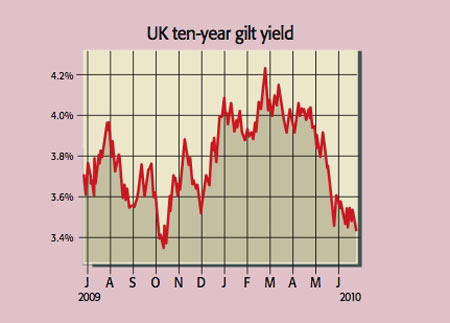

“Any pressure that the country’s triple AAA credit rating was under was released” by the speech, said Lex in the FT. Gilt yields have fallen to their lowest level this year and sterling edged up. Osborne’s budget was tougher than expected, as Capital Economics pointed out. It goes beyond Labour’s plans, pledging to virtually eliminate our deficit of £149bn over the next five years and amounting to an overall tightening of £113bn by 2014/2015. Labour had pencilled in a figure of just £73bn by this stage.

All this means “tightening until the pips squeak”, said Martin Wolf in the FT. With international aid and the NHS off limits, spending on other departments will be cut by 25% over the next four years. This will be a “bloodbath”. Pushing these cuts through will be a “brutal” struggle. It will begin in October when the spending review details the cuts. Meanwhile, the other key question is whether the sharp fiscal tightening could knock us back into recession.

The key reason to believe that it might not is that the government “has created space for the private sector to breathe again”, as Jeremy Warner pointed out in The Daily Telegraph. A reversal of 13 years of rising business taxation should give companies a more certain outlook and encourage investment. Besides, if we hadn’t seriously tackled the deficit, long-term interest rates could have rocketed as jittery markets lost confidence in our debt. For Osborne, “the long slog of delivery” is just beginning, but it’s encouraging that he “hit the ground sprinting”.