Investors ignore Africa at their peril. There are risks, but they’re probably no worse than those associated with many other parts of the developing world, such as Asia, South America and the Middle East.

There’s a lot going for the continent. It has an abundance of natural resources such as oil, metals, gold and diamonds, a young population of almost a billion people, and a consumer market set to reach $1.6 trillion by 2020.

Better still, demand is barely being impacted by global bank deleveraging, since there is practically no personal credit. And while Africa was once an exporter of human capital, many Western-educated Africans are now returning, bringing with them vital knowledge, experience and technical skills. This is all great news for conglomerate Lonrho.

The firm’s bread-winner is its agricultural division (71% of sales), which exports fresh fruit, vegetables, fish and meat to European, Asian and American supermarkets (including Costco Marks & Spencer, Tesco and Sainsbury), plus domestic chains such as Shoprite and Pick’n’Pay.

Lonrho (LSE: LONR)

The division recently scooped up an exclusive five-year agreement for rights to catch tuna off the coast of Mozambique, which could add £11m to revenues in 2013 and £22m in 2014.

Lonrho has its fingers in many other pies too, such as hotels, infrastructure and support services. It spun-out its loss-making Fly540 airline over the summer into a separately listed company called Fastjet, in which it owns a 67% stake.

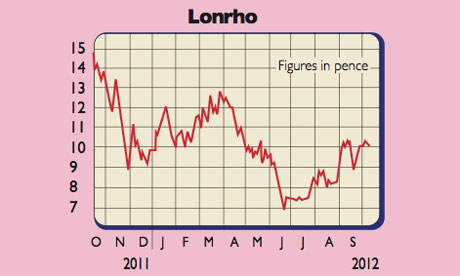

First-half revenues soared 29.1% whilst net debt fell to £78.7m by June from £102.7m in December. Broker Daniel Stewart expects sales to climb 33% to £270.8m in 2013 from £202.8m this year, delivering underlying earnings per share of 1p. I value the group on a price/earnings (p/e) ratio of 15, which suggests an intrinsic worth of 15p per share.

Lonrho could fall foul of geopolitical, foreign exchange, natural disaster, interest rate and/or commodity risks. And it may suffer from being spread too thinly. Nonetheless, the shares offer a brave investor a cheap entry point into a multi-decade growth story. Daniel Stewart has a price target of 20p.

Rating: SPECULATIVE BUY at 10p (market cap £160m)

Disclosure: I own shares in Lonrho.