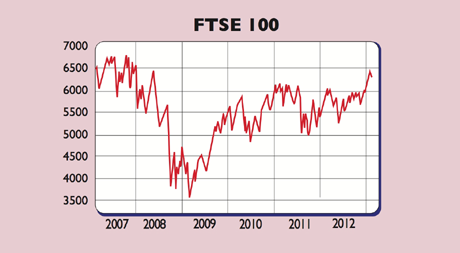

“Exuberance is the new cool”, says Ralph Atkins in the Financial Times. The FTSE 100 has had its best January since 1989. The Dow Jones has eclipsed 14,000 for the first time since before the crisis. Clearly, says an RBS note, “a sizeable proportion of the market is willing to entertain the idea that the glass is not only half-full, but might be filling up”.

But as we pointed out last week, while the global economy is looking better, it’s too early to assume the recovery is sustainable. And there is ample scope for fresh crises. However, while the fundamentals don’t justify the strong rally, there is plenty of liquidity to boost stocks. Risky assets always like low interest rates and money printing as these spur hopes of an economic recovery and some of the easy money finds its way into markets.

The upshot, says John Authers in the FT, is that stocks are in a “Goldilocks” scenario. In the 1990s and during the credit bubble, “Goldilocks” meant that the economy was not too hot and not too cold – cool enough not to force central banks to withdraw easy money by raising interest rates, but warm enough to keep fuelling profit growth. “Welcome to the sequel.”

This time, though, it’s slightly different. The economy is cold enough to prompt central banks to keep printing money and keep interest rates at historic lows. But it’snot so freezing that it’s still in crisis and thus panicking the markets. “While this combination persists, there is nowhere to go but upwards,” concludes Authers.

This state of affairs can’t last forever, of course. If the economic data get worse, as occurred last year after a solid start for markets, or a crisis flares up, a correction is likely – witness last Monday’s slide on bad news from Europe. If a crisis shakes markets badly enough, however, central banks are likely to ride to the rescue with more action.

This has been the basic pattern for equity markets in the past few years and the chances are that this will continue: “there’s still more zig-zagging up and down before we reach the promised land” of a sustainable bull market, says Jeremy Warner in The Daily Telegraph.

Whatever happens to the overall market, however, the key for investors remains the same: buy stocks that are cheap enough now to ensure long-term returns are healthy, and just hang on to them.