The Bank of England’s latest inflation report is particularly gloomy about the outlook for the British economy. It expects consumer price inflation to keep on rising in the months ahead and says it could be over 3% by this autumn. It is also set to stay above its 2% target for the next two years. If this happens, then inflation will have been above its target for more than five years.

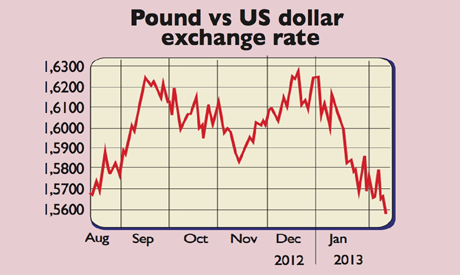

The main reason inflation is expected to stay high is the weakness of the pound, which has made imports more expensive. The currency markets reacted badly to the report, with the pound selling off by 0.7% against the dollar and 0.9% against the euro.

The Bank was equally gloomy about the outlook for GDP growth, which it expects to be subdued. It doesn’t see UK GDP being back to pre-crisis levels until 2015. Usually, higher inflation is met with tighter monetary policy and higher interest rates. The Bank knows the UK economy is too fragile to cope with this. So interest rates could remain at very low levels for the foreseeable future. Further quantitative easing (money printing) has yet to be ruled out either.

What the commentators said

Kathleen Brooks at Forex.com said the report was particularly bearish for the pound: “In our view, this Inflation Report does nothing to stem the pound’s decline, and its bleak economic and inflation outlook is a green light for the market to keep selling sterling.”

Joshua Raymond at City Index said that the bank’s inflation target was being ignored, given the fragile state of the economy: “The Bank remains between a rock and a hard place in trying to strike a balance between the rising pressures of inflation and supporting the economic recovery. Clearly, right now the Bank is firmly weighting its actions to the latter at the expense of inflation but the question is how long can this last?”

Jason Conibear at Cambridge Mercantile summed up the Bank’s approach to inflation by saying: “If there’s no chance of the targets being met, many will ask what’s the point of having them. Sterling’s rapid depreciation against both the euro and the dollar since the start of the year has fuelled inflation and further muddied the economic puzzle.”