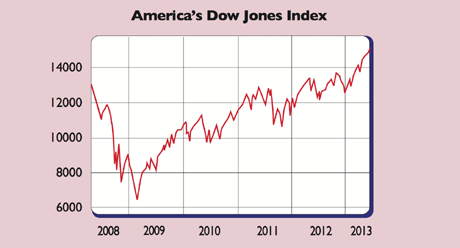

“A wave of bullishness” has swept through the stock markets of late, says Dave Shellock in the Financial Times. America’s Dow Jones index eclipsed 15,000 for the first time and the S&P 500 reached a new record above 1,600. Britain’s FTSE 100 hit a five-year high. The latest surge was due to an unexpectedly good American employment report.

Non-farm payrolls expanded by 165,000 in April, and the two previous months were revised up by a hefty 114,000. The unemployment rate fell from 7.65% to 7.5%, the lowest since December 2008. Unlike on several previous occasions, it fell for the right reason: more people working rather than fewer people looking for work.

Throw in last week’s slide in initial jobless claims and investors have become increasingly confident that the dip in the economic data at the end of the first quarter “is merely a temporary breather” rather than the start of a downtrend, says Unicredit’s Harm Bandholz.

Still struggling

Nonetheless, while the overall report was a positive surprise, it’s clear that the labour market is still struggling. Consider the so-called U6 Underemployment Rate, which covers not just the unemployed, but also those who are working part-time but want to work full-time and those who have stopped looking for work. U6 rose marginally to 13.9%.

Meanwhile, overall hours worked fell, suggesting that higher payrolls reflect many people accepting part-time jobs. Average weekly earnings declined by 0.4%. Another report showed that 306,000 people joined the ranks of the self-employed. All told, then, says Gluskin Sheff’s David Rosenberg, “we had a lot of folks ostensibly becoming consultants working out of their basement offices… and [not] picking up much business”.

Hooked on stimulus

The soggy labour market reflects the overall US economy: “growing, but maddeningly slowly”, as John Authers puts it in the FT. GDP growth is trundling along at an annual pace of around 2%, far lower than during the typical post-war recovery. Europe has shrunk for nearly two years and there is no sign of a turnaround. Britain is still limping along. Emerging markets, notably China, have slowed.

On both sides of the Atlantic, earnings and sales have been lacklustre and “companies are bearish for the future”. They are “talking down prospects at the fastest clip” since 2001.

The world economy has yet to make a sustainable recovery from the credit crisis. The emergency measures of late 2008 and early 2009, such as money printing, may have prevented another 1930s scenario, says Larry Elliott in The Guardian, but “five years on those… measures are still in place… We have become hooked on stimulus… that is not a healthy sign”. Yet the most important driver of stock markets now is central-bank activity.

More liquidity, or the prospect of it, brings out the bulls. Last week was a classic example, says Randall F Forsyth in Barron’s. The European Central Bank hinted at future moves to spur bank lending and the US Federal Reserve said it would boost or lower its monthly purchases of bonds, depending on the outlook. That reaffirmed “the best of all possible worlds for the stock market: good news is good news, while bad news means continued money printing”.

Moreover, the longer money-printing causes interest rates to sit at historical lows, the more desperate investors become for yield, says Gavyn Davies on FT.com. That is why defensive, traditionally high-income sectors are spearheading the rally. Markets based on liquidity rather than fundamentals, as we have pointed out before, are especially vulnerable to reversals if sentiment takes a turn for the worse.

The best approach is to wait for the inevitable dips and then top up holdings of historically cheap markets: Japan and Europe. We remain especially keen on Italy, which is on a price-to-book-value ratio of just 0.77. The iShares FTSE MIB exchange-traded fund (LSE: IMIB) tracks the Italian market.