Saltydog Investor aims to boost fund investors’ returns via a simple strategy: buy what’s rising, and avoid what’s falling.

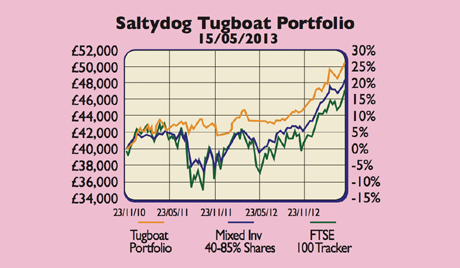

Read more at here. Saltydog’s Richard Webb updates us on its cautious portfolio, ‘Tugboat’.

Looking at the average performance of the top funds in each sector (using Investment Management Association definitions), most sectors rose for the third week in a row, with the exception of sterling corporate bonds, gilts, and index-linked gilts. In the lead were China and North America, with Japan not far behind.

So this week we’ve reviewed our sterling corporate-bond exposure. We’ve halved our holding in the Henderson Long Dated Credit fund, and put £5,000 in the CF Odey UK Absolute Returns fund. The absolute-returns sector is moving up our ‘Slow Ahead’ group of ‘cautious’ funds. This fund is up 5.8% in the last four weeks. The overall value of the Tugboat has grown by 0.7% since lastweek.

Looking ahead, the North American sectors are rising up the ‘Full Steam Ahead’ group of most volatile funds, although they still lag Japan and Europe. The shale oil and gas revolution means fuel prices continue to fall.

This will leave consumers with more disposable income, make US manufacturing more competitive, and generate many skilled jobs as the infrastructure is developed to recover this fuel. Another driver is the housing market recovery. The top US funds have risen by more than 3% in the last four weeks. We’ll watch to see if this trend develops.

• Sign up for Saltydog’s free trial at Saltydoginvestor.com.

| Saltydog Group | Fund | % | Last week |

|---|---|---|---|

| Safe Haven | Cash | 26% | 27% |

| Slow Ahead | CF Odey UK Absolute Return | 10% | 0% |

| Slow Ahead | Fidelity MoneyBuilder Income (Acc) | 20% | 20% |

| Slow Ahead | Henderson Long Dated Credit | 8% | 16% |

| Steady As She Goes | Chelverton UK Equity Income | 7% | 7% |

| Steady As She Goes | Cazenove UK Equity Income | 10% | 10% |

| Full Steam Ahead | Legg Mason Japan Equity | 13% | 14% |

| Full Steam Ahead | Neptune Japan Opportunities | 7% | 14% |