The world’s leaders in economic disappointment are determined to have inflation. They will get it, and so will your portfolio, says Dr Peter Warburton.

Financial markets have a small brain, capable of holding only a single thought at a time. Today’s markets are oscillating between the following two thoughts:

A: inflation is the inevitable consequence of reckless monetary policy.

B: inflation is impossible while there is so much spare capacity.

When markets fear inflation (thought A), commodity prices rise, commodity stocks outperform, and commodity currencies strengthen. Moments later, when fear of deflation (thought B) displaces fear of inflation, commodity prices slump, commodity stocks dive and commodity currencies weaken. So for investors, the vexing question is whether to buy assets that protect against rising global inflation, or those that prosper under deflation.

Some would argue that you should look at inflation ‘break-even’ rates. These rates compare the yield on conventional (fixed-income) government bonds with those on inflation-protected bonds, and are supposed to represent the markets’ ‘inflation expectations’. However, they are better understood as the price of inflation protection, or insurance.

If you insure your car or your house, then you require the insurance everyday. After all, you don’t know when any given disaster might strike. Investors, however, tend not to think about inflation insurance this way. When they believe inflation risks are receding, they cancel the policy and save the premium, expecting that the same rates – or better – will be available to them when markets return to fretting about inflation again. In truth, the price of insuring against inflation is a lot more volatile than people’s expectations for inflation, especially on longer time scales.

Simple ideas misrepresent dynamic systems

A variant of the markets’ ‘single-thought syndrome’ is the ‘short logic chain’ syndrome, epitomised by most financial reporting. Examples of such short logic chains include the following ideas: rising interest rates lead to a weaker economy; an increase in government spending leads to a rise in GDP; or falling commodity prices lead to deflation.

Short logic chains sound perfectly reasonable. Yet they misrepresent the workings of a complex, dynamic system. The most insidious short logic chain of all is the idea that ‘stronger economic activity means higher inflation’ and its corollary, ‘weaker economic activity means lower inflation’. Sometimes these statements apply, and sometimes they just don’t. Welcome to ‘Duckonomics’.

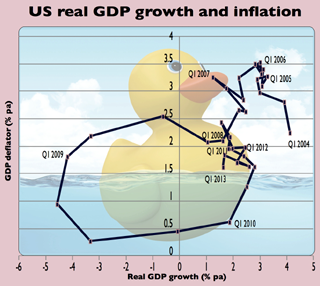

Take America. If growth and inflation were perfectly aligned, then all the data points on the scatter chart on the right-hand page (which plots US growth and US inflation against each other) would lie on a straight line, rising from bottom left to top right. In other words, growth would rise with inflation and vice versa. Plainly, as you can see from the chart, they do not. Instead, they trace the outline of a duck. Strengthening economic activity is sometimes associated with falling inflation. Weak growth and high inflation can co-exist and have often done so.

Where does inflation come from?

We need a comprehensive framework to grasp the outlook for global inflation. In a world of global supply chains and networks, this analysis makes sense only at the global level. So we have to consider all the potential ways that inflation gets into the system. Broadly speaking, there are four main pathways for inflation.

1. Keynesian ‘overheating’: think of the economy as one huge factory. Is demand for its output higher or lower than factory capacity? If lower, then resources are unemployed. If higher, then there is upward pressure on factory prices, and on the wages of its workforce.

2. Monetarism: households, firms and financial institutions have a predictable requirement for money (combining purchasing power and store of value). But the monetary authorities may supply more money than is needed. Once injected, this ‘extra’ money must be absorbed, which occurs through a general rise in prices.

3. Supply-side inflation: advanced economies have outsourced the production of goods and services to lower-cost producers in other nations. That leaves them vulnerable to inflation that arises in producer countries, then passes along the supply chain to consuming nations. Take the quantitative-easing-fuelled surge in global food and energy prices in 2010-2011, which triggered high inflation in many emerging nations. The local price rise led to higher wages, and in turn, higher producer costs. As an aside, when we calculate global consumer price inflation using population size, rather than economic size, as weights, the inflation trend looks a little different (as the chart on the left shows).

4. Fiscal inflation: this is when government budget deficits are financed by central-bank money-printing. Until the financial crisis erupted, government-generated inflation was tame. Since then, it has roared back to life as central banks have absorbed roughly a third of all new government bonds issued since the end of 2007.

This last route still has a very low profile, because bank lending to the private sector remains very weak in advanced economies. In effect, governments are generating replacement monetary growth and stopping the rate of global inflation from falling even lower. But inflationary danger looms if governments fail to shut down monetary financing of their deficits after private demand for credit revives. Once the central bank becomes the government’s financier, inflation expectations become well and truly unanchored. That would be bad news indeed for government-bond prices.

Compare the UK’s leading gold brokers

Compare the UK’s leading gold brokers

If you’re interested in buying gold, our up-to-date directory of the foremost gold brokers and ETF funds makes essential reading.

Compare the UK’s leading gold brokers

How does QE alter this picture?

So where do near-zero short-term interest rates and gazillions of quantitative easing fit in to this framework? Have the policies pursued over the past five years carried the global economy any closer either to sustainable economic recovery or runaway inflation (or both)? The answer, unfortunately, is doubtful on the economic growth front, but affirmative on the inflation side. Hopes that zero rates and quantitative easing (QE) would create a wealth cascade are foundering on both sides of the Atlantic. Japan might have to wait a little longer to reach the same conclusion.

By contrast, there are many indications that QE has lifted the medium-term inflation expectations of the public, undermining the solemn promises of the central banks. And worse is to come. Whereas conventional monetary easing (cutting short-term interest rates) permeates the financial system, large scale purchases of government bonds or mortgage assets clearly favour specific priveleged groups.

Capital market borrowers enjoy cheap rates, while small and medium-sized businesses remain dependent on banks and finance companies. The failure of QE to improve the common lot is its greatest indictment. Prepare for a backlash of popular disgust with far-reaching political consequences for the developed world.

Prepare for a political backlash

The case for the return of global inflation is ultimately premised upon financial, economic, social, demographic and political realities. Developed economies have huge debt burdens, for which there is no monetary resolution as yet. Equally elusive is a political resolution: how much longer can we run budget deficits at 5% of national income to allay voter anger? How can we keep a lid on geopolitical tensions that have their roots in access to affordable food, drinking water and energy? In our indebtedness, how will we finance the replacement and refurbishment of decrepit infrastructure before systems fail and there are supply crises?

Most poignantly, how will the conflicting interests of the generations be resolved? Older people want inflation to be held down to preserve the real value of their assets and pensions. Younger people want house prices to fall and to reduce personal debt burdens through rapid wage growth. In Britain, 76% of over-65s voted at the 2010 general election; 55% of those aged 25-34 and 44% of adults under 25. Imagine how the adoption of internet-based voting options might alter those proportions and how that might turn into a winning electoral platform in the future. The battleground for the global inflation-deflation debate is not gold, nor copper, nor iron ore, nor even oil. The true battleground is the global wage bill.

The wages of youthful emerging nations are already rising, heralding mass prosperity in Asia and Latin America. In the mature economies of North America, western Europe and Japan, a more complicated conversation is taking place between cash-rich corporations, embattled households and indebted governments. Fed chairman Ben Bernanke may have inadvertently killed off QE on 19 June. However, the successor policies may well include overt monetary finance: government spending funded by central-bank money creation, with an emphasis on lowering the unemployment rate of young adults.

Japan leads the developed world in economic disappointment and policy desperation. If Japan can confound its critics and steer a course towards 2% inflation, then the rest of the rich-world countries will not be far behind. The Japanese voters handed a politician, whose previous short tenure as prime minister ended in failure, a resounding mandate to reflate the economy. If Shinzo Abe succeeds in casting off the shroud of deflation in Japan, his will be a psychological and a political victory more than a technocratic one. The global stage is set for the return of inflation. Is your portfolio positioned accordingly?

• Dr Peter Warburton is director of Economic Perspectives Ltd.