Business services group Rentokil has had to cope with tough markets – particularly in Europe – over the last few years and has been fighting fires on a number of fronts. Its troublesome City Link parcel-delivery business has kept on losing money, which has weighed heavily on the whole company’s profits. As far as many investors are concerned, Rentokil shares are too much trouble for too little return. Yet I think they look quite interesting.

Rentokil has persuaded someone to buy City Link for the princely sum of £1, thus relieving the company of a major source of trouble. There’s talk that Rentokil’s facilities management business could be sold too. If that went, Rentokil would be left with three very solid businesses.

Its pest control, hygiene and work-wear divisions have decent market positions and can probably grow over the long haul. What’s particularly attractive about these businesses is that they are very profitable. Pest control and hygiene have profit margins of more than 20%. The workwear business is having a tough time in Europe at the moment and management is cutting costs, but its profit margins still come in at 16%. This contrasts with the 4%-5% margins made by many support services businesses.

Even with City Link losing money and facilities management (FM) having low margins, Rentokil still had a return on capital employed (ROCE) of more than 20% last year, which is far from shabby. With City Link gone and FM possibly to be sold for a decent sum, ROCE could increase and debt would come down too. This may make Rentokil much more tempting to a corporate buyer.

While trading is currently tough, the impact of cost savings and recent acquisitions means that City analysts still expect earnings growth of 10% for the next two years. On 10.5 times 2013 forecast earnings, I think that Rentokil’s shares are worth a gamble.

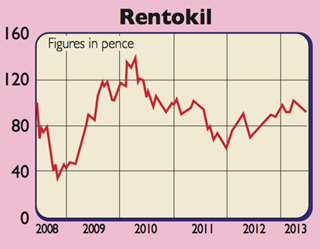

Verdict: speculative buy at 89p