John Menzies’ move from newspapers into aeroplanes is worth backing, says Phil Oakley.

John Menzies opened its first book stall in Edinburgh in 1833. Over the next 165 years, it established itself as a prominent bookseller, newsagent and stationer across Britain, before switching to focus on its logistics business. Instead of selling newspapers and magazines, it became a middleman, collecting them from the publisher, then distributing to retailers.

For many years this has been a tough business with wafer-thin profit margins. Newspaper and magazine circulation has been steadily falling as more people get their media over the internet. Menzies’ profits have held up as it gets paid on a percentage of cover prices, and publishers have been putting these up year after year. Menzies has also cut costs as the volume of work has gone down.

Sooner or later, of course, you run out of costs to cut. But the firm hasn’t been standing still. It saw the writing on the wall for the news business and in the early 1990s it branched into aviation services. Despite what you might think, this business has a lot in common with news distribution: demanding customers who need vital tasks to be performed efficiently and on time. Menzies is now the second-biggest independent player in the aircraft ground handling market.

Should you buy the shares?

On the face of it, there are plenty of reasons to avoid shares in Menzies. There’s no growth in distributing newspapers and magazines, and most airlines struggle to make money and will always be looking to cut the prices they pay their suppliers.

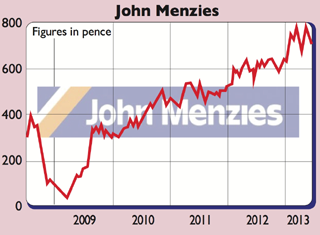

Yet despite these headwinds, Menzies’ shareholders have done quite well. The share price collapsed during the 2008-2009 financial crisis, but it has recovered nicely since then. Indeed, despite the challenging economics of news distribution, Menzies has done a good job of maintaining its profits. It will cut a further £10m in costs over the next three years.

Menzies has also managed to sign new deals with News International and Marketforce, the second biggest distributor of magazines in Britain. The company is diversifying into new areas and, crucially, the business doesn’t need to spend much money to stay afloat, so it is a great source of surplus cash that can be paid out to shareholders.

The growth potential lies with aviation. Airline customers struggle to make money consistently, and the business is very sensitive to what’s going on in the world economy. But for good companies such as Menzies, there is scope to grow. Having got rid of some loss-making contracts in its cargo-handling business, it can focus on the better prospects offered by passenger airlines.

Areas such as check-in and boarding, baggage handling and aircraft cleaning may be unglamorous, but they are also critical. Activity here is measured in the number of aircraft ‘turns’. Menzies expects the available market to grow from 31 million in 2012 to 46 million in 2020. Three-quarters of this market is still in the hands of the airlines who do their own handling. Increased outsourcing should give Menzies a good chance of growing. It wants to double its share of the market from 3% to 6%.

Menzies’ strategy is focused on 50 airports across the world where it thinks it can make good money. I expect it to keep winning new contracts and retaining business with its existing customers.

It also has a very strong financial position, which may allow it to buy capacity at target locations. By partnering with the right airlines at the right airports, Menzies could see strong profits growth over the next decade.

Menzies is a cash-generative company offering steady profits and dividend growth. At about 700p, it trades on just over ten times this year’s expected earnings, with a prospective yield of 3.7%. It’s still worth climbing on board.

Verdict: buy

Menzies (LSE: MNZS)

Share price: 703p

Market cap: £426.7m

Net assets (Dec 2012): £79.2m

Net debt (Dec 2012): £93.3m

P/e (current year estimate): 10.1 times

Yield (prospective): 3.7%

Interest cover: 13.9 times

What the analysts say

Buy: 3

Hold: 1

Sell: 0

Target Price: 840p

Directors’ shareholdings

C Smyth (MD Aviation): 116,734

D McIntosh (MD Dist’bn): 84,097

I Napier (Chair): 5,000