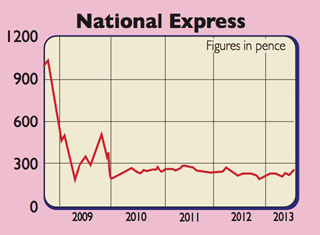

In March last year, I tipped National Express at 237p. You’d have been better off sticking your money in a FTSE 100 tracker.But last week’s half-year results suggest the company is doing a good job of turning itself around.

Profiting from buses, coaches and trains isn’t easy these days. These businesses have always relied on some government subsidies – to pay for things like bus passes for pensioners and fuel duty rebates – to make profits. With governments looking to save cash, these subsidies have been cut. High oil prices and weak economies don’t help either.

Yet National Express’s profits are holding up well even in Spain, where having a coach business which offers affordable travel has proved helpful. One key draw of investing in this company is that customer demand and revenues at several of its businesses are quite stable: commuters on trains and buses, and students going to school, for example.

Meanwhile, coach travel is thriving, as people look to shift from trains and planes as a way of saving money. This makes National Express a relatively low-risk business, providing it is run well.

And that’s why I still think this company is a good investment – it hasn’t been run well in the past, which means there’s a lot of work left to be done to improve performance. The current management team looks like it can deliver some decent profit gains in the next few years.

I particularly like the focus on generating more cash and improving the returns on capital employed (ROCE). National Express expects to generate at least £150m of free cash flow, which gives the shares a free cash flow yield of 11.5%. The school bus business in America should be able to improve its ROCE and squeeze out more cash too.

The areas where it is looking to grow – buses in America and trains and coaches in Germany – don’t need much investment, as the buses and trains are paid for by the customer.

This should mean that National Express is capable of generating more cash and using it to repay debt and grow its dividend. If it can do this, it will create a more valuable business for shareholders.

A big business in Spain means that there’s still some risks to the profit outlook, but this looks factored into the share price. Trading on 11.5 times 2013 earnings with a secure 4% dividend yield and decent cash flow, the shares are still worth buying.

Verdict: keep on buying