The high-street bookie has struggled, but the shares are worth a punt, says Phil Oakley.

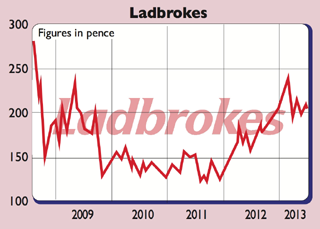

It’s difficult to know what to make of bookmaker Ladbrokes (LSE: LAD) as a potential investment. A cursory look at its accounts gives the impression of a business that is struggling to make much progress. Profits and dividends are both lower than they were five years ago. So is the share price.

And in April the company gave the bears more meat to stick their teeth into when it issued a profit warning. Bad weather, lots of winners at the Cheltenham horse racing festival, lower profits from high-rolling punters and a sluggish performance from its online business all mean that this year’s profits are set to be lower than last.

It’s no surprise that peers such as William Hill are more highly rated. So is an investment in Ladbrokes dead money – or can it turn itself round?

Vice stocks can do very well

Bookmakers, like booze and tobacco businesses, are ‘vice’ stocks. If you can put aside ethical considerations, there’s a lot to like about such businesses. Gambling, like smoking, can be addictive, which is why people want to ban it. But it also means that betting companies can rely on a steady stream of cash. And despite the growth in online gambling, betting shops are among the few businesses holding their own on Britain’s depressed high streets. Ladbrokes plans to open 100 new shops (net of closures) in 2013.

The ongoing health of the betting shop is partly down to the fact that they aren’t the dingy, downmarket places they used to be. And as well as becoming more welcoming, they have found extra ways to get punters to part with their cash. In recent years there has been a boom in the number of fixed-odds betting terminals (FOBT) in shops. These have provided bookmakers with a growing and more stable form of income than regular over-the-counter betting on horses, football and greyhounds.

Meanwhile, all the sport on TV, and the growth of smartphones and tablet computers, has fuelled the growth of online betting with services such as live ‘in-play’ bets to entice the punters. Overall, it’s a huge market and it’s only getting bigger and more widespread.

You’d think it would be a great industry to be in. So what on earth has Ladbrokes done wrong for its profits and share prices to have been so lacklustre?

What Ladbrokes has done wrong

Ladbrokes’ most glaring problem has been its inability to build a decent online betting business that customers like and stick with. Other companies such as William Hill have excelled here and Ladbrokes has been left behind. The fear among many investors is that Ladbrokes is too far behind to catch up.

And the trouble is, Ladbrokes needs to catch up. Its betting shops might be surviving, but they are loaded up with lots of fixed costs (those that must be paid, regardless of business levels, such as staff wages and rents). Any downturn in business here – as we have seen in the first few months of 2013 – can lead to a big fall in profits.

And continued growth in this area is going to be hard as Ladbrokes – along with most of its peers – has already stuffed its shops with as many FOBTs as the regulations allow. On top of that, more competition is entering the market, while taxes on the income from these machines are rising too.

But there may be a glimmer of hope. Its online business should get better. It has done a deal with Playtech, a company which knows a thing or two about online betting having previously owned a slice of William Hill Online. Improvements will take some time to come through, but profits should rise in 2014. Throw in the fact that some of the bad betting results may not be repeated, combined with events like the upcoming football World Cup, and things could be looking a lot better in 12 months’ time.

And even if profits take a while to improve, the dividend looks sustainable, given the ability of the business to generate lots of surplus cash flow. Last year, Ladbrokes generated £145m of surplus cash, which was almost enough to cover its dividend payout twice over. With a prospective yield of 4.3%, you are being paid to wait for things to improve.

Should you buy the shares?

Ladbrokes’ shares look cheap, (unsurprising, given all these problems), trading on 13 times this year’s expected earnings, compared with William Hill (LSE: WMH) on 16 times. City analysts expect profits to grow by 14% in 2014. If they don’t, and the shares fall further as a result, then it’s possible that Ladbrokes could attract a takeover bid.

That’s partly because of another threat to the gaming sector – tax. Governments see betting companies as a good source of tax and the online-betting sector has been good at avoiding this by basing itself offshore. But if online betting starts being taxed based on where the customer is playing, rather than where the company is, then profits will be squeezed. There may not be enough money around to keep all bookmakers happy.

Ladbrokes has a decent brand and could be seen as a good business to buy to squeeze out more costs. Another management team may also be better at running it than the existing one. So while times are hard for Ladbrokes at the moment, I think it could be a share to own over the next year or so.

Verdict: speculative buy

Ladbrokes (LSE: LAD)

Share price: 207p

Market cap: £1.9bn

Net assets (Dec 2012): £421m

Net debt (Mar 2013): £341m

P/e (current year estimate): 13.0 times

Yield (prospective): 4.3%

Interest cover: 7.9 times

What the analysts say

Buy: 5

Hold: 14

Sell: 3

Target price: 215p

Directors’ shareholdings

R Glynn (CEO): 1,460,255

I Bull (FD): 351,316

P Erskine (chair): 90,095