Brazil is doing terribly, but that’s no reason not to buy. It’s cheap, and will one day be a global economic powerhouse, says John Stepek.

What was the worst-performing major market of the first half of 2013? Without looking at the figures, I’d have guessed China or Russia – and I’d have been close. Those two fell by around 13% and 16% respectively in the six months to 30 June. But outdoing both, with a fall of 22%, was Brazil.

On reflection, it’s little wonder. Emerging markets in general have had a tough year for two main reasons. The first is the dawning realisation among mainstream investors that China – the key player in the whole emerging-markets narrative – is slowing down. Its apparently never-ending expansion meant some investors started to take its strong demand for commodities for granted. Now, as the economy shows clear signs of slowing, investors are keen to get out of investments they see as commodity or China-dependent. Brazil ticks both boxes – China is its biggest export destination.

The second reason is that investors worldwide are scared of what the Federal Reserve will do next. With the US economy showing signs of recovery, they are now worried that the US central bank will start tightening monetary policy. Or at the very least, it will stop loosening monetary policy at a rapid rate (in other words, it’ll print less than the current $85bn a month to buy bonds).

No one’s quite sure of what this ‘tapering’ will mean for the markets, but they’re not waiting to find out. Money has flowed out of emerging markets, hammering both currencies and asset prices. As well as being one of the worst-performing markets this year, Brazil’s real has been among the hardest-hit emerging-market currencies. For all the bad press that India’s rupee has gathered in recent weeks, the real has fallen even harder against the dollar – down 14% in 2013 so far.

On top of all that, Brazil has some unique problems of its own, not least of all the very public protests over rising living costs that kicked off earlier this year. Dilma Rousseff’s government has made all the usual mistakes that governments tend to make in the quest for popularity.

As The Economist notes, after Rousseff became president in 2011, she tried to stimulate growth through increasing public spending, raising the minimum wage, and “forcing state-run banks to lend more”. When inflation inevitably rose as a result, she tried to tackle this by holding down prices artificially (including bus fares) and cutting sales taxes.

These sorts of sticking-plaster measures tend to come back to haunt a nation in the end – it was a modest rise in bus fares that kicked off the recent protests. Brazil now has weak growth, above-target inflation, and a disgruntled, over-indebted populace, which, having got used to ever-improving living standards, now wonders where the good times have gone.

So why buy Brazil?

So all this rather begs the question: why on earth would you buy Brazil now? Well, there’s one very good reason at least: it’s cheap. As former Société Générale analyst Dylan Grice has pointed out on many occasions, there’s no such thing as toxic assets, just toxic prices. According to investment manager Mebane Faber, at the start of July, Brazil was trading on a cyclically adjusted price/earnings (CAPE) ratio of just below ten.

While the market has risen a bit since then, that’s still unquestionably cheap. It compares to the US on above 20, and it’s cheaper than both China or India (though not as cheap as Russia, which probably makes sense, given the level of political risk involved there).

We’re also at a point where the market may have gone too far in pricing in the bad news. The currency slide may look ugly, but it’s worth remembering that, not so very long ago, the strong real was seen as a problem. After all, it was Brazil’s finance minister Guido Mantega, who in 2010 gave the world the phrase “currency wars”.

Mantega was complaining that the US and other developed economies were using loose monetary policy to weaken their currencies, damaging the economies of export-driven emerging markets. You can see why he was worried – at the time, the real was stronger than at any point since before the financial crisis, with a US dollar buying you just 1.6 reais or so. Now you’ll get more than 2.2 reais to the US dollar – that’s around a four-year low.

Controlling inflation

It’s true that this presents a potential problem for Brazilian central bankers and politicians. A weak currency tends to push up domestic inflation, which is already high, at around 6.3%. By Brazilian standards, this is within the bounds of normality – Brazil’s inflation target is 4.5%, plus or minus two percentage points. However, it’s not far off the top of the range, and with the population already protesting over rising transport fares, and a squeeze on living standards, it’s a big political issue.

Markets are now worried that Brazilian interest rates will have to rise steeply to keep inflation under control – investors expect the central bank rate to rise to 12% by the end of next year, from 8.5% now. The risk is that rising rates could squeeze Brazil’s already slowing economy.

It’s a classic emerging-market dilemma – fearing the twin threats of inflation and capital flight, the central bank and politicians end up having to crush growth instead. However, markets may have got ahead of themselves, reckons Neil Shearing of Capital Economics.

For a start, because Brazil is “a relatively closed economy” – ie, it imports very little compared to many other nations – a falling exchange rate doesn’t automatically lead to a huge surge in inflation. Also, the main recent driver of inflation has been food prices – but “global agriculture prices have been falling in US$ terms”. So even if the real stabilises where it is against the dollar, inflationary pressure will recede. Brazil is also less dependent on external funding than most other emerging markets, so there is little pressure to raise rates to attract foreign capital.

And those politicians back in 2010 were complaining about the strong real for a reason. In the second quarter of 2012, the strength of the currency contributed to manufacturing exports falling by 8%. In the second quarter of this year, exports recovered to grow by 3.1%. So, says Shearing, while “policy makers will want to avoid a disorderly adjustment in the currency… at the same time, a weaker real is necessary to rebalance growth away from an excessive reliance on consumer spending and towards greater investment and exports.” In short, he believes that while rates will rise, massive rate hikes are unlikely, and the authorities will likely tolerate a weaker real than anyone expects.

Adds Tony Volpon of Nomura in Forbes: “What investors should realise is that, despite the current stresses in the economy, recent developments represent a shock that is taking Brazil out of the bad equilibrium of low growth and high inflation that has prevailed since 2011.”

The country needs to become more competitive – in other words, wages need to fall – and “although the government has been unwilling to address this issue directly for obvious political reasons, this is now happening and there is nothing that can be done by the government to stop it”. So the weakening currency may not be bad news at all for Brazil.

Preparing to shine on a world stage

As for political unrest, to a great extent, Brazil has been a victim of its own success. Around a third of the population was living in poverty in 2004. By 2009, that had fallen to just over a fifth. The headline-grabbing aspect of the protests, as far as the rest of the world was concerned, was that these protestors were middle-class. These are not the poor and the desperate – they are the aspirational and frustrated.

These people have got used to seeing their lives improve, and they want more: better public services, more opportunities, and better infrastructure. And between the looming World Cup in 2014, and the Olympics in 2016, Brazil’s government has a huge incentive to get its act together before it appears on the world stage. As we saw in Britain, a decent sporting event can provide a handy boost to national morale. And unlike in Britain, Brazil could do with spending a great deal more on its infrastructure.

Brazil is ranked 101st out of 144 countries by the World Economic Forum in terms of quality of infrastructure, notes Joe Leahy in the Financial Times. Only 16% of Brazilian roads are paved, with the result that “driving is the second-most dangerous activity in Brazil after being a gangster”. The country is investing $42bn a year over the next two years in ports, airports, railways and roads. “The June protests have given new urgency to the overall infrastructure drive which had become stalled in bureaucracy and in bickering over returns, with the government keen to minimise perceived price-gouging by private investors.”

Even Brazil’s dependence on China may not be quite the handicap it’s perceived to be. China is slowing down, no doubt about it. And its role as successor to the US as global superpower has been hugely exaggerated – a point we’ve been making for the past three years. But markets may now be getting overly panicky about a slump in China too. Yes, China is slowing. But growth in other parts of the world is picking up.

The whole reason why investors are worried about the Fed cutting back on the money it’s pumping into the US is because the economy seems to be recovering. Even Europe is showing glimmers of life. Any recovery in these markets would help China’s exporters. And for all that China faces plenty of problems, the country isn’t going to vanish off the face of the earth. It will still be importing commodities, including the agricultural commodities Brazil is abundant in: soya is one of Brazil’s fastest-growing exports to China.

The point is, Brazil looks cheap. That might just be justifiable if Brazil faces a crisis that promises to unwind all of the undeniable progress it has made in the past decade or so. But it doesn’t. The country has lots of problems, but as Josh Brown notes on his blog, The Reformed Broker, these are “signs of adolescence and economic immaturity that we can always expect to see as a developing country awkwardly finds its legs”. In fact, Brown reckons that if he had to pick one non-US market to buy and hold for ten years, Brazil would be the one. “I would be shocked, if by the mid-point of 2023, ten years from now, this country hasn’t become an economic powerhouse.”

Brazil has some huge underlying advantages. At a time when ugly demographics – in the form of ageing populations – is one of the biggest worries facing developed-world investors, Brazil has the world’s fifth-biggest population, with a median age of 29. That compares to 39 for the US (which is relatively young by developed-nation standards). Almost half of these people are now considered middle-class. “This is a massive consumer base with more disposable income than ever.”

In short, says Brown, “the opportunity for Brazil – both the nation and its stocks – is as plain as day”. A rapidly growing middle-class consumes more and the economy comes to rely on exports less. “A young, vibrant nation of people who want more for themselves and are no longer afraid to speak up for it is a tantalising proposition.

“In this context, the ramp up to the Summer Olympics could be just the thing to reintroduce Brazil’s domestic potential to global investors once again after years of complete apathy.”

The best investments to buy now

David C Stevenson looked at his favoured emerging markets here. He would rather focus on Asia than Latin America. While I agree with his take on value-investing in Asia, and that there are some tempting-looking plays in that area, I think it would be a mistake to ignore Brazil, given its potential. As with Asia, any sniff of a comeback by China would also be good news for this country. So I would devote at least a portion of the emerging-markets section of your portfolio to Brazil.

Our favoured option for investing in Brazil would be to use a fund. You can buy individual stocks, and we’ll look at a couple in a moment. But if we’re talking about getting some exposure to an entire country, you want something that gives you a nicely diversified range of stocks in one convenient package.

Arguably the most convenient option for a British investor is to invest via the iShares MSCI Brazil Fund (LSE: IBZL). While the index isn’t perfect – it is heavily weighted towards Brazilian oil company Petrobras, Brazilian bank Itau Unibanco, and iron-ore giant Vale – it is London-listed, has done a decent job of tracking its benchmark, and is a cheap way to access Brazil, with a total expense ratio of 0.74% a year.

For the more adventurous, there’s a range of more specialised ETFs, listed in the US. Global X Brazil offers ETFs skewed towards consumer stocks (NYSE: BRAQ), financials (NYSE: BRAF) or mid-caps (NYSE: BRAZ), and there’s also an infrastructure specialist ETF: EGS INDXX Brazil Infrastructure ETF (BRXX).

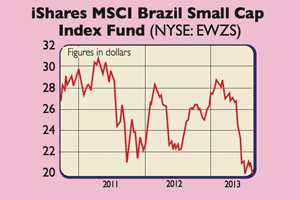

However, I’d rather get broad exposure than focus too heavily on any one sector. Another, perhaps more interesting option is the iShares MSCI Brazil Small-Cap Index Fund (NYSE: EWZS). This is currently trading at its lowest level since launch in 2010 (see chart right). Its top three holdings are Estacio, a provider of university-level education; Equatorial Energia, an energy-generation and distribution group; and real-estate company PDG Realty.

In terms of individual stocks, as Alexander MacLennan points out on Motley Fool, Latin American airline Gol Linhas Aereas Inteligentes (NYSE: GOL) has been hit hard by the falling Brazilian real (most of its costs, such as fuel prices, are in dollars, while its revenues are in reais). The share price has roughly halved in the past six months.

However, prospects for the airline look promising: it is cutting costs, and expanding into new routes. If Brazil’s economy continues to grow, it will profit from both rising consumer traffic and business traffic. If the real shows signs of bottoming out, it should help the stock too. It’s risky, but you could certainly see it as a leveraged play on the Brazilian economy.

Another interesting stock which has also seen its share price fall hard is Cosan (NYSE: CZZ). The conglomerate produces ethanol and sugar, and has expanded into logistics and fuel distribution. JP Morgan has a price target of $23 per share on the stock, compared to a current price of around $14. The investment bank believes the company has plenty of room to improve its share of the fuel market and thus increase its profit margins.