Russia is playing politics. Its relations with the US are not far off a post-war low. President Vladimir Putin has said that any US action against Syria would be an “aggression”.

It isn’t getting on very well with its neighbours. It is, says the FT, stirring up “politically-charged trade disputes” with countries from the Ukraine to Moldova, in response to their gestures towards joining any kind of EU free trade area.

And internally, the government isn’t covering itself in glory either. Last month a Russian court jailed opposition leader Alexsi Navalny for five years for corruption. Or perhaps just for, as the BBC puts it, “campaigning against the endemic corruption and coining a phrase to describe the ruling party United Russia that has stuck in everyone’s minds –‘the party of crooks and thieves’”.

Doesn’t sound nice, does it? My guess is that you think it isn’t somewhere you should be keeping your money.

You could be wrong…

What investing is all about

Investing is all about one simple thing.

It is about buying cheap, selling dear, and – as City old hand Peter Bennett of Taylor Walker puts it – “having the ability to put up with being considered two slices short of a sandwich for a very large part of the time”.

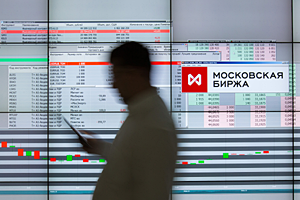

Right now, Russia comes with about the lowest stock valuations you can find anywhere in the world. It is on a price/earnings ratio of a mere 5.5 times, and a price to book ratio of 0.75 times (ie you can buy companies for a mere 75% of the stated value of their assets).

That’s cheap relative to everywhere else, and cheap relative to Russia’s own valuation history. Both measures are now much where they were back in 2008, and not far off half their averages over the last ten to 15 years.

You will say that this makes sense. After all, who wants to pay normal prices for assets which are based in a very abnormal state? Surely anything dependent on a slowing economy, that is in itself dependent on gas and oil, is to be utterly shunned? As is any investment that comes with the appalling corporate governance on offer in Russia.

These are all perfectly good points. But there is cheap and there is cheap. And at these prices the Russian stock market is so cheap it is practically pricing in a return to communism.

That can’t be ruled out (though I think I am happy to rule it out). But it is, I think, much more likely that things in Russia will improve, from a market point of view at least. It is that change – and other people’s understanding of that change – that we should be betting on.

Russia could be set to turn a corner

I met with Ruffer’s Jon Dye a few weeks ago. He notes that whatever you might think of Putin, he does grasp the problem. He has noted that Russia can no longer “postpone structural reforms” and that it is important to make the “Russian stock market competitive in the full sense of the word, make it attractive for Russian and foreign market players”.

A great many measures have been introduced, aimed at increasing investment in Russia. A draft code of corporate governance has finally appeared. There are plans to privatise non-resource state assets. And in November, the government introduced rules that require companies with state ownership to pay out a minimum of 25% of their profits to shareholders.

This year, the majority of firms managed to get themselves exempted from the rule, but it seems likely that it is going to be tightened up. In June, first deputy prime minister Igor Shuvalov announced a “tougher stance” on payouts. If that happens, it has pretty dramatic implications for the dividend payout of Russia’s big companies.

Will any of this actually happen? It won’t be smooth – that much is obvious. And the risks are very high.

But as Navalny himself put it: “this can’t go on for ever… a situation in which 140 million people in one of the biggest and richest countries in the world are subjugated by a handful of worthless monsters… a bunch of former Komsomal activists turned democrats turned patriots who grabbed everything into their own hands”.

We can’t comment much on the second part of his tirade but on the first we are pretty certain – this can’t go on forever. So it makes sense to buy at the kind of prices that still suggest it will. Today’s prices.

My colleague James McKeigue recently wrote on the best ways to invest in Russia. in MoneyWeek magazine. If you’re not already a subscriber, subscribe to MoneyWeek magazine.

• This article is taken from our free daily investment email, Money Morning. Sign up to Money Morning here.

Our recommended articles for today

Six stories to rock the markets this month

Markets seem pretty relaxed about the big stories coming this September, says Bengt Saelensminde. All the more reason for investors to watch out.

What financial advisers can learn from estate agents

The financial services industry should take a leaf from the book of this new breed of estate agency, says Merryn Somerset Webb.