It’ll be a struggle, but Greene King’s pubs will prosper in the long term, says Phil Oakley.

Greene King (LSE: GNK) has been in business for more than 200 years and has established itself as one of the country’s best pub and brewing companies. It owns around 2,300 pubs, restaurants and hotels, trading under brands such as Hungry Horse, Old English Inns and Loch Fyne restaurants. The company is also Britain’s leading brewer of cask ales, with top sellers such as Greene King IPA, Abbot Ale and Old Speckled Hen.

Pubs have been a classic boom-and-bust sector of the UK economy. During the last decade they prospered on the back of a debt-fuelled consumer boom. However, the trend of loading up pubs with lots of debt was to prove costly for many pub companies when people stopped spending.

Not so long ago, the rents from local tenanted pubs were seen as a source of steady and predictable cash flow. These were exactly the sort of assets that investment bankers saw as ideal for raising lots of debt against. With debt being cheap for companies, and lots of investors looking for safe sources of income, many fancy financing deals were done. However, a deep recession, a smoking ban (which put many customers off going out) and higher beer taxes exposed the foolishness of this debt binge.

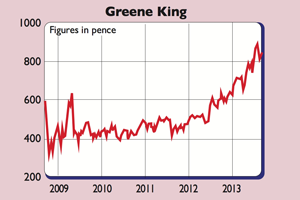

Greene King played its part in this, but its strong retail pubs and brewing businesses meant it proved more resilient to the fallout than others. It was the only major pub company to maintain its dividend during the financial crisis of 2008/2009, and it has recovered strongly since then. Its focus on the right customers in the right locations has paid off.

Of course, this is already well known by the market. Its shares are in favour with investors, having gone up by 42% during the last year. So is it time to cash in, or is there still more to go for?

A different kind of pub

There’s a lot to like about Greene King’s business. It is very different to debt-laden, struggling rival pub companies, such as Enterprise Inns and Punch Taverns. It has more than 1,000 high-quality retail pubs and restaurants. These pubs are owned and managed by Greene King and are targeted at the growing market for eating out in Britain. This market has been growing for many years and should keep on doing so in the years ahead, as there is a growing tendency among people aged 18 to 35 to eat out, according to a recent study by Deloitte. Greene King gets around two-thirds of its profits from these pub/restaurants.

What’s even better is that people in London and the southeast – where it has most of its pubs – eat out more than those in any other region in Britain. If the UK economy keeps recovering than the outlook for Greene King should be good.

Greene King is looking to add another 100 retail pubs over the next two years, with a big push on its Hungry Horse brand, which focuses on value for money. The company is confident that through a combination of new builds, selective buying of pubs, and transfers from its tenanted estate, it can earn decent returns on its investors’ money that should allow it to grow profits and dividends. This is welcome, as Greene King’s return on capital employed (ROCE) is still a very modest 8.9%.

The new pub investments are earning returns of between 12% and 15%. With investment currently growing faster than profits, it’s going to take a while for ROCE to improve and shareholders will have to be patient.

Is there any growth to come?

Any growth will be hard won. The market for eating out is brutally competitive, with lots of rivals chasing the same customers. The cost of running pubs has been going up over the last few years – food, drink and utility costs – and there is constant pressure to be more efficient and keep prices as low as possible.

However, Greene King has done a good job here, offering key items such as burgers and premium lager at cheaper prices than many of its competitors without sacrificing quality. This has helped it gain a bigger market share. In terms of the risks, the company’s balance sheet still has too much debt on it in my opinion. In fact, it looks more like one you’d see at a water or electricity company, rather than a consumer-facing business. This is a legacy of a big purchase of tenanted pubs in 2004, which were funded with lots of debt that was secured against the property values of the pubs.

Thankfully, this debt pile should continue to come down as more tenanted pubs are sold, while the company is also very good at generating surplus cash flows after it has paid all its bills. Greene King’s brewing business is very helpful here, as it requires little additional investment while still selling more ales.

What to do with the shares now

So what about the valuation? Well, Greene King shares are not cheap at the moment. They trade on nearly 14 times next year’s forecast earnings and offer a reasonable dividend yield of 3.3%. But they are not outrageously expensive either. Current trading has been good on the back of the excellent summer weather. Like-for-like sales in the retail business have grown by 4.6% in the first 18 weeks of the company’s financial year. A stronger British economy could see higher profits than people currently expect and more cash flows to pay down debt.

Given that the odds of this happening seem to be increasing, combined with the high quality of Greene King’s assets, the shares could still go higher from here. It’s one to put away for the long run.

Verdict: long-term buy

Greene King (LSE: GNK)

Share price: 849p

Market cap: £1.85bn

Net assets (April 2013): £972m

Net debt (April 2013): £1.44bn

P/e (current year estimate): 13.9 times

Yield (prospective): 3.3%

Interest cover: 2.9 times

What the analysts say

Buy: 8

Hold: 7

Sell: 1

Target price: 878p

Directors’ shareholdings

R Anand (CEO): 282,128

M Fearn (CFO): 13,576

T Bridge (chair): 1,362,760