Inflation has fallen below the Bank of England’s target rate of 2% for the first time since November 2009. Consumer Price Index (CPI) inflation dipped to an annual rate of 1.9% in January, down from 2% in December.

Meanwhile, jobless data continue to be positive. While the unemployment rate jumped from 7.1% to 7.2% in the three months to December, employment rose by 193,000, while the number of people out of work and claiming benefits slid by a hefty 27,600 in January.

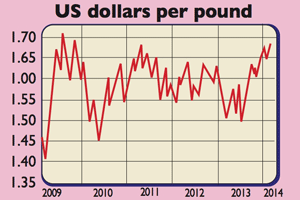

The pound, buoyed by the recent run of good news, hit a five-year high against both the dollar and a basket of the currencies of Britain’s major trading partners.

What the commentators said

The rise in the unemployment rate is likely to be “just a blip”, said Capital Economics. It’s due to more people becoming available for work, offsetting those that actually got jobs. The tone of the data remains positive.

Especially encouraging, said Deutsche Bank, is that the pace of full-time jobs growth is at its highest level since the early 1990s. The number of part-time jobs has also started to fall, suggesting that part-timers are migrating to full-time work.

In the meantime, the edge is coming off the ‘cost of living crisis’. Earnings are still only growing at an annual rate of 1.1%.

However, this figure seems likely to rise as the recovery spreads, and inflation may also continue to fall in the next few months: utility companies are set to lower prices, producer price inflation (which measures cost pressures further up the chain) is weak, and the strong pound is keeping a lid on import prices. So the hope is that wage growth will finally outstrip inflation later this year.

Of course, that won’t make the crisis suddenly disappear, as Patrick Collinson pointed out on Guardian.co.uk. It will take years for workers to recover their spending power. Real wages (ie, adjusted for inflation) are at 2004 levels. It’s also worth noting that the old measure of inflation, which includes housing costs, ticked up to 2.8% in January.

Yet even though the recovery has yet to become fully entrenched, markets are pricing in an interest-rate rise in February next year. This may be too early, but other major central banks are “not yet even seriously considering” tightening monetary policy, said Lee Hardman of Bank of Tokyo-Mitsubishi UFJ. So the relative appeal of the pound, and hence its ascent, could continue.