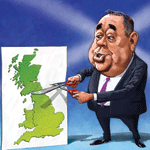

Could an independent Scotland become the next Singapore, or would a ‘Yes’ vote be an act of national self-harm? Merryn Somerset Webb investigates.

In the late 1690s, Scotland’s government granted a charter to the Company of Scotland to set sail and attempt to establish a colony on the coast of Panama.

The interesting thing about this adventure is not so much its miserable end (most people died and only one ship returned to Scotland)*, but the way in which Scots of all sorts took part in it.

The Oxford Dictionary of National Biography puts it like this: “While Williamites and Jacobites remained implacably opposed over the monarchy, they came to be united in a belief that the Company of Scotland offered the prospect of national and personal prosperity. The original joint-stock company of 1695 was now the vehicle for the Scottish colony of New Caledonia, supported by a remarkably diverse group of Scots who had set aside their many and varied differences in pursuit of national glory and personal wealth.”

They didn’t get either, of course. The wealth was lost and the union (which allowed participants to recoup their losses via a payment from England to Scotland known as ‘the equivalence’) was found.

But the idea of pulling together in the name of national glory and personal wealth is finding its parallel in the variety of people prepared to vote for Scotland to separate from the rest of the UK (rUK) in the referendum on 18 September.

There are wealthy people voting ‘yes’ because they genuinely believe that post-independence Scotland would find itself in such a tricky financial situation that it would be forced to roll back the welfare state and become the Singapore of Europe – a low-spending but very wealthy small state.

Others – of a libertarian bent – think the removal of one layer of government (Westminster) is in itself a good thing, regardless of the centralising tendencies of its replacement. There are those who think that Scotland is less rich than it could be, because it is held back by being part of the union.

Then there are those who are convinced that the Scottish are different to those living in the rest of the UK – that the Scots have a keener sense of social justice and of the evils of inequality, and so will vote in governments that bring about real change.

They see a future in a more socialist state, where a drive to redistribute wealth somehow creates it, and where ‘fairness’ (definitions of what is fair can, I find, vary) reigns above all.

Among this group are those who are determined that Scotland should “have the government it votes for” and who feel this isn’t possible under the current arrangements. Finally, there are those who just feel a strong sense of nation and want Scotland to be independent regardless of the social or economic arguments.

MoneyWeek’s editor John Stepek (a born Scot) and I (a Scottish resident with a vote) have both made our own positions clear on this over the last few months. We are both firmly pro-union.

We aren’t remotely convinced by the Singapore argument – no one has ever yet really rolled back a welfare state and it seems highly unlikely that Scotland (where not far off 50% of GDP comes from state spending) would be the first. You could turn Singapore into Scotland over a few decades if you put your mind to it. But not Scotland into Singapore.

It is worth noting that so far the Scottish government has shown itself to be rather more into interfering than letting be (look up ‘named persons for children in Scotland’ on Google if you’d like to shock yourself in that respect).

We are utterly unconvinced on the values argument. This has gone oddly unchallenged, but Scotland’s sense of social justice is all but identical to that of the rest of the UK – as John McDermott noted in the FT this week, the Scottish Social Attitudes survey shows that “Scots have broadly similar views towards social security benefits, the unemployed, immigrants and tuition fees”. Any differences, says Professor Lindsay Paterson of Edinburgh University, are far too small to “signal a fundamental gulf of social attitudes”.

Not convinced? Then you might ask why, if Scotland is so mad for progressive policies, it doesn’t use the powers it already has to implement them. Health is devolved. Education is devolved. Holyrood controls business rates, has the right to vary income tax by 3p in the pound (a right it has now so definitively declined to use that HMRC has mothballed the software it created for its use), can raise money for infrastructure projects, and controls around 60% of the country’s expenditure.

Yet neither educational outcomes nor health outcomes have improved since devolution begun, while policies such as no up-front tuition fees at university, free prescriptions and care for the elderly “largely benefit the middle classes”, says McDermott.

Next year, under the painstakingly negotiated Scotland Act 2012, Scotland gets even more power – the right to vary income taxes by 10p in the pound, power over stamp duty, land taxes and landfill taxes and the right to raise money in the markets, to name but a few. That, you might think, would be challenge enough – particularly given that all party leaders have promised further devolution if there is a ‘No’ vote.

Finally, regular readers will know that we don’t buy the idea that Scotland would either be economically better off or even more independent outside the union. Those “flirting with a dreamy socialist idyll”, says The Times, might like to remember that a ‘Yes’ vote could “entail a future with less government money rather than more”.

It might also be far more volatile: no one knows how much oil is left in the North Sea, but everyone knows how hard it is to extract and how unpredictable its price is (the price of Brent crude is currently at a 16-month low, despite the increasingly nasty geopolitical situation).

Undecided voters might also like to note that all the financial assumptions underlying the SNP’s case for independence rest on a currency union. A currency crisis of any kind would make a nonsense of every number.

But this is not about whether Scotland can or can’t go it alone. With the right policies, of course it can. This is about whether doing so will mark an improvement. The only question that matters to us is this: will the economic and social standard of living for most people in Scotland be better post-independence than before? The evidence suggests the most likely answer is ‘no’.

We are of the general view that the point of all political activity is to make as many things as possible better for as many people as possible, so this conclusion is the key plank of our unionism.

Still, try as we might to persuade them that we are better together, we can’t persuade everyone to our way of thinking. The YouGov poll for The Times done in July showed that those in favour of continuing the union had a comfortable 18-point lead.

The most recent one shows that lead down to six points, as undecided voters move to ‘Yes’ “by a ratio of two to one”. That means it is time for the UK government, UK residents and the markets to start taking this whole thing seriously. This week it seemed that process finally began.

An FT headline announced: “Scots vote fears rattle City”. Firms with heavy cross-border exposure saw share price falls (2.4% for RBS on Tuesday) and “investors rushed to buy protection against swings in sterling around the date of the vote”. The pound has also been weak – down from a peak of $1.71 to $1.65 earlier this week.

Is this sudden reaction paranoia? No. The markets are beginning to grasp not only that a ‘Yes’ vote is possible (if an astonishing act of national self-harm), but also that a ‘No’ vote is a problem too.

As a recent report from UBS points out, a ‘No’ vote will still “lead to significant changes for the UK and perhaps Europe”. It means further fiscal devolution, which “may have a bearing on UK debt dynamics”. It will have a bearing on the UK general election – ‘rUK’ will want to see action on the West Lothian question and a fall in the number of Scottish MPs in Westminster with the rise in devolution.

If the margin of victory is narrow enough to suggest another referendum in the near future, the markets must still price in a risk premium to equity and bond markets for the ongoing uncertainty. Add in the horrible divisions and anger already apparent in Scotland and a ‘No’ vote clearly doesn’t mean “business as usual”.

It would, however, be better than a ‘Yes’ vote. Right now, there’s a core assumption among all participants that this will be controllable – negotiations will take longer than 18 months but will be controlled and amicable. This, say the economists at UBS, is “naïve”.

Markets don’t work like that. Instead, there’s a good chance that there will be a scenario more like that seen when the Czech Republic and Slovakia separated in 1993. They too “envisaged a negotiated separation”, but got near-chaos with “markets dictating the pace and terms of key aspects of the separation”.

So, what exactly should UK residents be nervous about? Four main things – we run through them in the box below.

The four key things investors should watch out for

The main result of an unexpected ‘Yes’ vote on the UK would, as one fund manager told the FT, be an “unfathomable” level of uncertainty – not only about the result of the negotiations, but also about their amicability and timing.

Brian Wilson, former Labour trade minister, UK business ambassador and chair of the firm that produces Harris Tweed in the Hebrides, made an excellent point on the matter in Shetland this week.

SNP campaigning assumes everyone will make nice around the table. But common sense actually says “the country state you’ve just walked out on is not going to be falling over itself to accommodate you”.

That’s particularly so, given that talks will begin just as the UK gears up for its own election: all parties will have to explain what compromises they will and won’t make with the Scots, and there are unlikely to be many prizes for those who back big concessions. Worse, no negotiations can realistically take place before May 2015. Why? Because the SNP can’t be sure that the government they are negotiating with pre- and post-May will be the same, so they can’t be sure any deals made will survive.

So there will be a very nasty period in which talks are pointless and we will know nothing about debt, currencies, defence, or anything else. The results of that are unlikely to be happy ones. Here are four (from a long list) that UK investors should watch.

1. The first thing to really worry about is capital flight. Deutsche Bank put out a widely ignored report in May in which it noted that money is likely to “flow unchecked” out of Scotland while Edinburgh frantically fights to make a currency deal with a mostly uninterested rUK.

A new Scottish currency, or the prospect of one, would also “trigger capital flight by worried savers ahead of any decisions being made”. UBS agrees this is a whopper of a risk. During the Czechoslovak separation, the idea was that a currency union would stay in place for six months while the new central banks sorted themselves out. That didn’t happen.

“Companies and citizens were not prepared to await the outcome” and bank deposits drained from the weaker partner (Slovakia). The “façade” of economic negotiation collapsed and the currency union lasted six weeks.

Will the same happen to us in the six weeks after a ‘Yes’ vote? It is entirely possible. Savers are by definition people with a low tolerance for risk: if there is even a chance of anything less than a full monetary union, they will pull money out of Scotland.

This would make life very tricky for the Bank of England (which would have to act as a lender of last resort and manage a falling Scottish money supply alongside a rising rUK money supply), but would also further weaken Scotland’s negotiating position.

2. The gilt markets. If rUK refuses to enter into a currency union with Scotland (which I think its voters will insist on), the SNP says it will repudiate its share of UK debt. That would push up the UK debt-to-GDP ratio by more than nine percentage points.

However, UK GDP would also rise as Scotland’s financial sector moved south, so the total rise in debt would be more like four percentage points.

That’s not really a problem for the UK, given the scale of its debt already, and it is almost certainly better than taking on the costs of a monetary union. However, while we wait for this conclusion to emerge (which it surely will – not least because Scotland will realise that currency union isn’t independence), there is likely to be some risk to the UK’s credit rating and some upset in the gilt market: what foreigner would want to buy in as the squabbles kick off? The risk premium has to rise and prices to fall.

3. The pound. Given the unfathomables and the risks inherent in them, we can expect sterling to weaken as well. How much? Consider a very fast fall of 2%-4% to be a “bare minimum”, says Bill O’Neill of UBS. We do.

4. The UK equity market. All this volatility has to have an effect on business confidence. Scottish firms don’t make up much of the UK index (just over 3% of the total, according to economists Paul Marsh and Scott Evans), but there are 100 listed Scottish firms.

You can expect the prices of shares in them to fall pretty sharply as they come to terms with the odds of a new and weak currency (Barclays suggest that a new Scottish currency will instantly fall 15% or more against sterling); uncertainty over EU membership; rising domestic interest rates (there are few scenarios under which Scottish rates will not rise); and a rise in the frictional costs of trade.

You should also expect prices to fall across the market as a whole to reflect the general rise in political and business risk.

So what do you do? If you need foreign currency in the next few months, buy it now. Avoid shares in firms with significant exposure to Scotland – from wind-farm operator Infinis Energy to FirstGroup and Standard Life, as well as some of the big defence contractors, such as BAE Systems. Keep out of the gilts market in the short term. And consider moving your deposits out of Scottish banks before the rush.

More sophisticated investors could follow James Mackintosh’s advice in the FT: buy protection against default by RBS, using credit default swaps (CDS). It’s “cheap to do” and “ultimately London would have to stand behind RBS and it would probably shift its HQ south”. But in the chaos of a ‘Yes’ vote, it is “easy to see how” investors would push the CDS price up in the short term. Get it right and you could turn a nice profit.

Beyond that, there isn’t much you can do. As one fund manager put it: “even if you were to know the results of the referendum, it would be difficult to make money out of it because it is hard to predict what would happen”. Frightening, isn’t it? One more reason to vote ‘No’.

* If you’re interested in this ‘Darien Scheme’, Douglas Watt’s The Price of Scotland is still the go-to book on the matter.

• This article was published in the 5 September edition of MoneyWeek magazine. Sign up here for a free four-week trial.