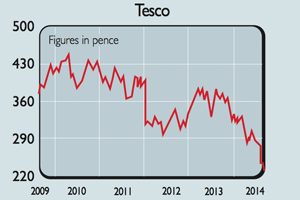

Most investors knew that Tesco (LSE: TSCO) was in a mess and probably weren’t surprised when it issued another profit warning last week. However, a 75% cut in the dividend payout was even worse than many expected. Unsurprisingly, Tesco shares have fallen heavily since then.

But is this as bad as it gets for Tesco? I’m not so sure. I think things could still get a lot worse before they get better. Even though Tesco’s shares have fallen a long way, they are by no means cheap. Tesco’s problems cannot be fixed quickly.

In the UK, it has taken its eye off the ball and faces strong competition. It does not lead the market on price or quality and is stuck in no man’s land between the discount supermarkets (Aldi and Lidl) and quality operators such as Sainsbury’s, Waitrose and M&S.

During the last years of Terry Leahy’s reign, Tesco didn’t spend enough money on its UK stores to keep them looking fresh. Instead, it sold lots of stores to property companies and then rented them back. The resulting cash was then reinvested into foreign ventures – most of which have produced very disappointing returns for investors.

For years Tesco has struggled to generate large amounts of surplus or free cash flow – certainly not enough to pay its dividend. The size of the proposed dividend cut shows how unsustainable the old dividend was.

Yet how on earth is Tesco going to boost its cash flow in the future? To win back customers it needs to cut prices. If the customers don’t come back, sales, profits and cash flow will fall further. With lower sales, Tesco will get less generous terms from suppliers.

When sales were growing, generous credit terms boosted Tesco’s trading cash flow. But with falling sales, this process could go into reverse. Tesco also needs to spend more money on its stores to make them more attractive to customers, which will reduce free cash flow further.

Tesco’s aggressive sale and leaseback programme in recent years means that it has massive off-balance-sheet rent commitments of £15.9bn, according to its last annual report. Further sale and leaseback deals would be unwise for a business with falling sales, and that means Tesco can’t raise any more cash from its property portfolio.

I don’t think Tesco’s potential profit and cash-flow problems are anywhere near reflected in a share price of 228p. As I explained in a recent investment strategy article, my favourite valuation measure is trading profit divided by enterprise value (EBIT/EV), which gives a form of earnings yield. (EBIT stands for earnings before interest and tax, which is the same thing as trading profit.) Cheap shares offer high yields.

Tesco says that its trading profit will be around £2.4bn this year, and its market cap is currently £18.5bn. So if you add net debt of £6.7bn, you get an enterprise value of £25.2bn and an earnings yield of 9.5%.

However, Sainsbury’s, which is arguably a better business right now, offers an earnings yield of 11%. So Sainsbury’s is the cheaper share.

If Tesco offered the same yield as Sainsbury’s with £2.4bn of profits, it would have an enterprise value of £21.8bn (2.4/0.11). That equates to a market cap of £15.1bn or a share price of 186p.

But what if profits don’t bottom at £2.4bn and Tesco shares have to be cheaper than Sainsbury’s by offering a yield of 12%?

Well, if Tesco cuts its operating margin to 3.5%, it would generate profit of £2.19bn on sales of £62.5bn. Put that on a 12% yield and you get an enterprise value of £18.2bn, which equates to a share price of only 142p.

But what about net asset value (NAV)? At the end of February, tangible NAV per share was 134p. Given the lower profit outlook, I wouldn’t be surprised to see some big writedowns in the value of Tesco’s supermarkets, which will reduce NAV further.

So you can’t justify a share price anything close to 228p on a NAV basis. In short, now is not the time to buy Tesco.

Verdict: avoid