The question of whether countries that have higher growth tend to have higher investment returns over the long term is a hotly contested one. Studies come to different conclusions: the answer seems to depend on which countries you look at, the time period involved, whether you consider inflation-adjusted returns for local investors or foreign-currency returns for international investors, among other factors.

However, over the shorter term, the picture seems clearer. Studies suggest that, over periods of a few years, countries with the best GDP growth prospects tend to offer higher returns – certainly once currency movements are taken into account.

For example, Elroy Dimson, Paul Marsh and Mike Staunton of London Business School looked at the performance of emerging markets from 1976 to 2013*.

They found that stocks in countries whose growth was in the top 20% of countries over the following five years outperformed those in the bottom 20% by more than ten percentage points per year – an enormous premium. Other studies show similar but smaller effects for developed markets.

The problem here is that this is based on future growth. That’s great if you have perfect foresight, but for those of us who aren’t soothsayers, it’s rather dangerous. Why? Because when we’re trying to guess which countries will post the strongest growth in the future, our judgement will be biased by which ones have grown most strongly in the recent past. And studies have also found that investing in the countries that have been growing strongly tends to be a recipe for underperformance.

Dimson, Marsh and Staunton found that stocks in the 20% of emerging markets with the strongest growth over the past five years went on to underpeform those with the weakest growth by more than ten percentage points per year. Again, a similar but smaller effect seems to be present in developed markets.

Why does this happen? It’s down to two factors. First, investors get too excited about countries that have delivered good growth in the recent past and push up stocks until they are too expensive, meaning that they are likely to deliver weaker returns in future. Second, because economies are cyclical, those that have grownexceptionally strongly for the past five years are quite likely to slow down and be weaker performers over the next five years, just as investors flood in.

Value, not growth…

It’s clear that unless we are able to predict future growth very well, betting on it is definitely a risky strategy. So what about the opposite of growth investing – value investing? Historically, buying cheap, unloved stocks has outperformed buying expensive, exciting ones. Does the same hold true for countries?

The evidence suggests strongly that it does. For example, Dimson, Marsh and Staunton found that investing in stocks from the 20% of emerging markets with the highest dividend yield outperformed a strategy of investing in the 20% with the lowest dividend yield by more than 20 percentage points per year – roughly twice the premium from being able to predict future growth perfectly. Once more, other studies suggest the same is also true to a lesser extent for developed markets.

Not only has the outperformance from selecting countries based on value comfortably beaten the outperformance from selecting on future growth, but a value strategy is considerably more useful. While we can only attempt to estimate future growth, the current dividend yield is known and easy to obtain. That makes a value investing strategy far more relevant to real-world investing.

The last question is whether there is any way to put these two effects together. If we know that countries that grow well tend to outperform and those that are cheap tend to outperform, what happens when countries are cheap and subsequently grow more strongly than expected?

… or better still, both

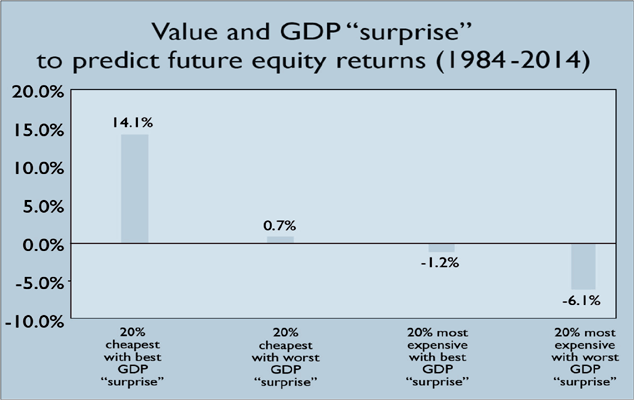

It’s no surprise to find this is the most potent combination. According to Ben Inker of investment management firm GMO, the cheapest countries that posted the best GDP “surprise” over the next three years outperformed the average country by 14.1 percentage points per year from 1984 to 2014**. (He defines the GDP surprise as being the extent to which future GDP growth beats what you might expect based on previous growth.)

This handily beats the gain from just picking the cheapest countries (3.2 percentage points), or those with the best growth (2.6 percentage points). What’s more, even the group of cheap countries with the worst GDP surprises – those that grew slower than expected – still slightly outperformed the average country, by 0.7 percentage points per year.

So the obvious conclusion is that if you’re going to try to pick countries that are likely to grow well, make sure they’re also relatively cheap. If you get both calls right, history suggests that you should do very well. If you end up with too many slow growers, the cheap valuations still give you scope to do okay. Conversely, buying expensive markets is likely to bring disappointment, regardless of whether you guess right on growth or not.

*Emerging Markets Revisited, Elroy Dimson, Paul Marsh and Mike Staunton, Credit Suisse Global Investment Returns Yearbook 2014

**Ditch the Good, Buy the Bad and the Ugly, Ben Inker, GMO Quarterly Letter Q4 2014