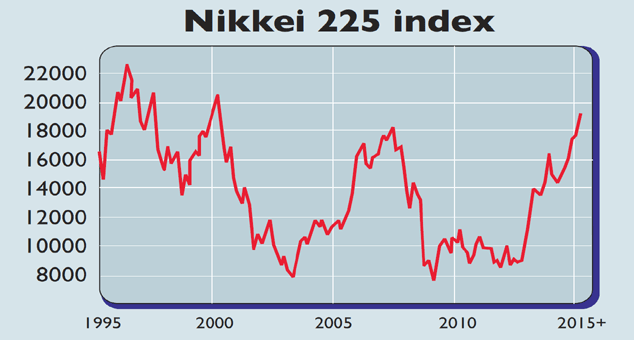

Last week, the Nikkei 225, Japan’s main index, “reclaimed the psychologically important 20,000 mark, a peak last seen in April 2000”, says the FT. Stocks climbed strongly in recent months “as Bank of Japan (BoJ) supports the market with an unprecedented asset-buying programme, while domestic pension funds tweak their allocation targets to favour equities”.

At the same time, Abenomics, the three-pronged revival programme from Prime Minister Shinzo Abe, is showing signs of progress, with firms raising wages. Although the economy “is still limping out of a recession from the second to fourth quarters of last year”, this weak growth “has only convinced investors that the BoJ will unveil another trick in its sleeve”.

In other words, expect more quantitative easing (QE) if the economy fails to pick up – which, based on what’s happened during previous rounds of money printing, seems likely to boost stocks further.

Can stocks go higher?

Hence the latest rally is “seemingly unstoppable”, says Mia Tahara-Stubbs on cnbc.com. It’s been given a further boost by foreign investors entering the market on the expectation that Japan’s “frugal” firms will “start coughing up more cash to shareholders”.

Recent news stories suggest this trend is finally under way – last month’s announcement that successful but notoriously shareholder-unfriendly robotics firm Fanuc is bowing to pressure from investors for more transparency and higher payouts may be a turning point. “With dividends and share buybacks also expected to rise, cash equities buying by foreign investors is expected to continue in a sustained way,” says Shun Maruyama of BNP Paribas.

Japan is also benefiting from what Chao Deng in the Wall Street Journal calls an “increasing global appetite for Asian stocks”. Hong Kong’s Hang Seng index “ended a three-day week up 7.9% at 27,272.39 as its rally accelerated”. This was the biggest weekly gain since October 2011. Against this favourable backdrop, there’s a growing consensus that Japan will make further gains.

True, there’s a risk that the Nikkei “may have risen too far too fast” in the shorter term, says Maruyama, but the index is still likely to end the year higher at around 22,000. Others are far more optimistic: Ben Collett of Sunshine Brokers thinks that there’s “a 50% chance the Nikkei will rise to 30,000 in a year’s time”.