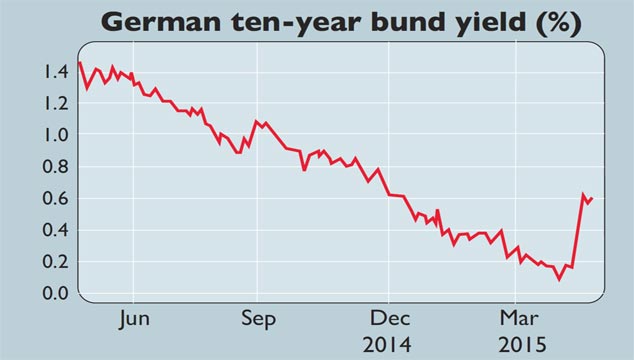

“So much for risk-free assets,” says James Mackintosh in the FT. In normal circumstances, it’s hard to imagine an investment with a safer reputation than German government bonds. But recently they have been anything but stable. Last month, the European Central Bank’s money printing had kicked in and deflation jitters were spreading, causing investors to rush into bunds, pushing prices up and yields down.

By mid-April the yield on the ten-year bund reached a record low of 0.05%. Then, within three weeks, the yield soared more than tenfold as prices slumped. Early this week, the ten-year bund yield was trading just below 0.6%. That marked the biggest bund rout since 1994 in total-return terms. Yields in other European countries, as well as in the UK and America, have also leapt. So what’s going on?

“My feeling is that there has been a shift away from deflation worries… towards some kind of reflation story,” says Frederik Ducrozet of Crédit Agricole. Inflation expectations reflected in bond markets – known as break-even inflation rates – have risen in recent weeks as inflation figures have improved. Investors are now factoring in low inflation, rather than falling prices. In particular, oil prices appear to have made a major contribution to ending the deflation scare. Brent crude has rebounded to $70 a barrel, a 50% increase on its multi-year low in January.

To compound matters, a flood of eurozone debt is hitting the market, with €60bn of net issuance expected in the next four weeks. “It’s a form of indigestion,” says HSBC’s StevenMajor. “There just isn’t the same appetite for bonds at ultra-low yields.” Government bonds have been in a bull market since the early 1980s, and yields are now vanishingly small, or negative. So the major question is whether the multi-decade bond bull market is finally over.

Don’t count on that, says Deutsche Bank. The “seemingly interminable” decline in Japanese bond yields since the early 1990s has been punctuated by 18 spikes in yields. The absolute low in yields may have been reached, but with European money printing continuing, inflation low and central banks in no hurry to raise interest rates, they may not slide much further. But whether they stay at ridiculously expensive levels or take a further tumble may not matter. Either way, they are not an attractive investment.