I think I am a little in love with Steve Silbertstein. The FT describes him as a “millionaire philanthropist”. And that, he surely is. But the key thing he is currently doing is not the kind of thing most people would immediately recognise as philanthropy. He is picking a fight with BlackRock, the world’s largest asset manager, on the basis that they voted in favour of 97% of US pay reports last year when they really shouldn’t have.

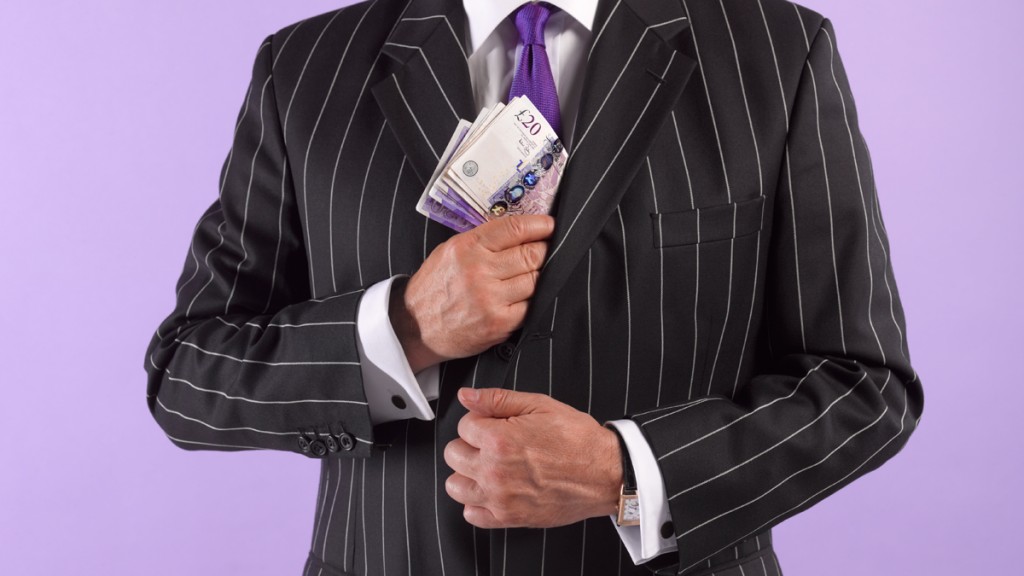

Given the shockingly high level of CEO compensation, he tells the FT, BlackRock’s failure to take a stand means that “they are allowing executives to line their own pockets rather than directing (corporate profits) towards shareholders as dividends… pretty soon all the money in the economy will go to the chief executives as they keep raising their pay each year.”

He also pinpoints a reason why BlackRock might not be too keen to rock any pay boats: Larry Fink, its chief executive, is paid around $26m a year, a sum which to most minds will seem quite a few million too high.

Silbertstein hasn’t got far in his campaign yet. The resolution he put forward at the AGM this year to try and force BlackRock to put a tiny bit of effort into policing high pay was firmly defeated (presumably by the votes from the other overpaid fund managers holding BlackRock shares, most of whom will have been advised on how to vote by a few super-powerful advisory groups). But he isn’t giving up. “I will continue this campaign” he told the FT. I really hope he does.

The good news is that he isn’t alone in having just about had enough of executive excess. Fatcat pay is turning into a global issue. The Swiss held a referendum last week that asked whether all state-owned companies should be forced to become non-profits and their managers then banned from receiving salaries higher than those of comparable government employees. The vote was a “No” (68% against, although the polls had suggested it would be much closer) but the conversation was interesting.

At the same time, it is worth noting that shareholders have rebelled against pay deals at WPP, Citibank, BP, Goldman Sachs, Standard Life, Anglo American, Shire and Deutsche Bank.

There is also an excellent chance that our hero and the other shareholders beginning to wake up to the scale of the plunder of the companies they think they own might be about to get a helping hand from the market.

Another story in the FT tells of a new report from McKinsey that suggests that between 30% and 35% of the profits of the global investment management business could be “wiped out” by 2018 thanks to high costs and cheap competition: note that since 2007 the assets under management in the passive industry have risen four times faster than those in the active industry.

If that happens, there might not be enough money knocking around to pay the likes of Fink $26m – and if he isn’t getting his millions perhaps he will take a different view of other people getting theirs. Which would be nice.