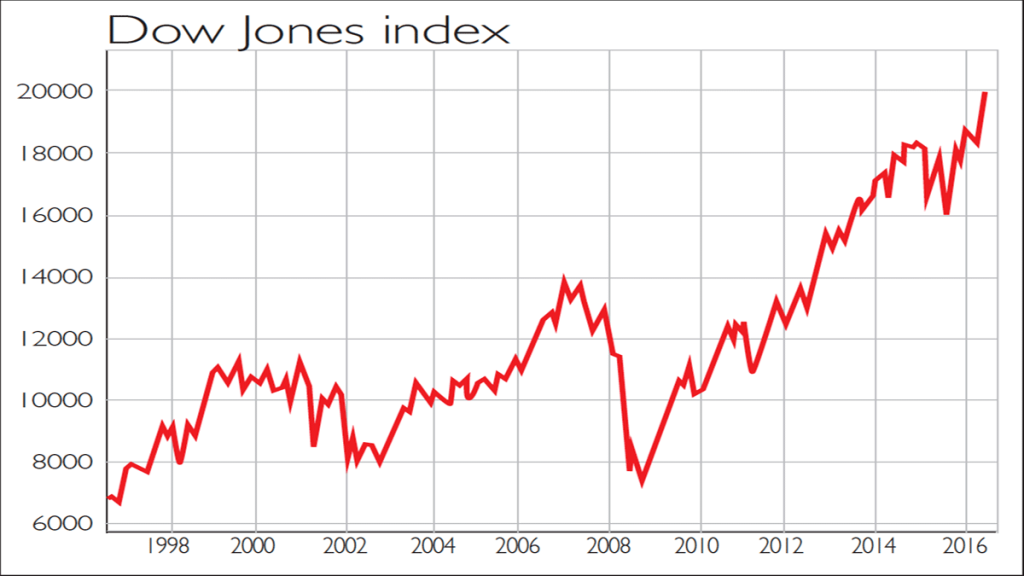

There has been a lot of fuss in the past few days about the Dow Jones Industrial Average reaching the 20,000 mark. Ignore it. The Dow Jones index is an anachronism that provides a skewed view of market movements. Most indices, notably the benchmark S&P 500, are weighted by market capitalisation: the share price multiplied by the number of shares available. So, quite reasonably, firms with a higher market value get a higher weighting in the index tracking that market.

The Dow, on the other hand, weights companies by price, not market cap. This is because equity indices were a new concept when Charles Dow constructed it in 1896. Back then, it comprised 12 companies, and adding all the companies’ share prices together and dividing by 12 produced the value of the index. It was a fairly simple calculation for people to remember.

But the problem with a price- weighted index is that if a share in company A costs twice as much as one in firm B, A will make up twice as much of the index even if B is actually a much more important company with far more shares available than A. Fast-forward to today, with the Dow now encompassing 30 firms, and we have the absurd situation of Goldman Sachs being the top firm in the index simply because of its $240 share price. By market value Apple is America’s – and the S&P’s – biggest company. The fact that The Wall Street Journal handpicks the Dow’s 30 firms skews the picture further.