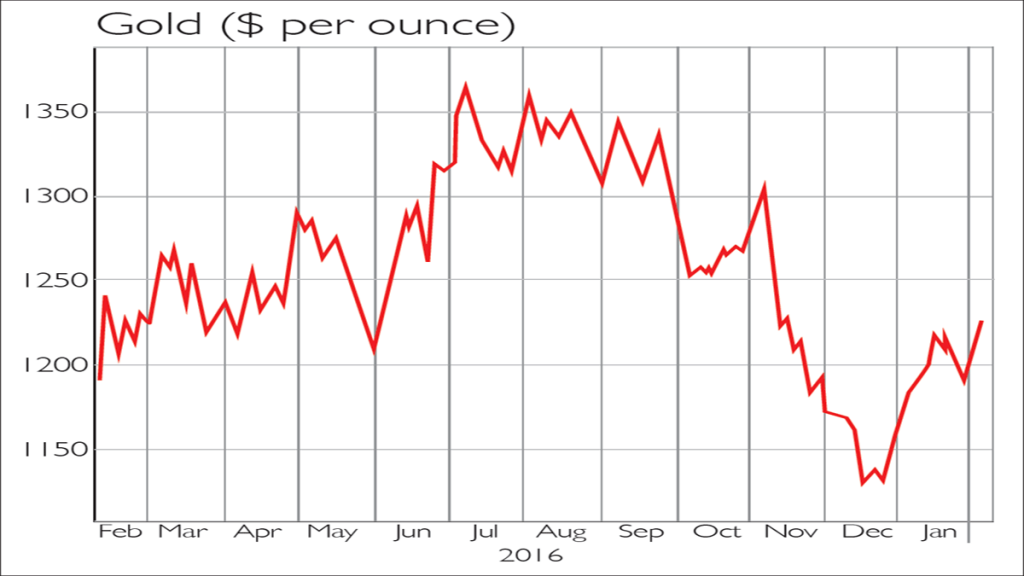

Gold slipped in the weeks after Donald Trump’s election, but it has bounced back to a two-month high, and there should be further to go. Investors had pencilled in a strong dollar and rising interest rates in the US, but are now realising that these trends are not as certain to materialise as they initially assumed (see story above). Trump has also “swapped diplomacy for Twitter”, as Lex puts it in the Financial Times. His protectionist instincts could start a trade war and deal the world economy a severe blow. Investors seem increasingly “likely to want some form of geopolitical hedge”.

Viewpoint

“Deutsche Bank and UBS are… forecasting sterling at or near parity with the euro this year as [Britain’s talks with the European Union] turn tetchy and companies start to move operations abroad. This is a brave hypothesis given the populist revolt sweeping large parts of Europe – and above all Italy – and given the risk of a fresh default crisis in Greece just before the German elections. While it is unlikely that Holland’s Geert Wilders, France’s Marine Le Pen and Italy’s Beppe Grillo will take power this year, they may do well enough to shift the political centre of gravity in unpredictable ways.”

Ambrose Evans-Pritchard, The Daily Telegraph