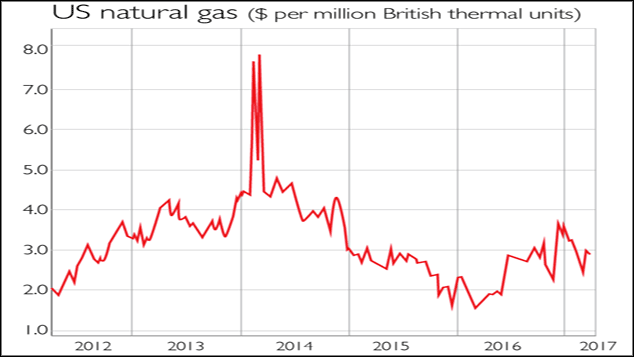

Natural gas prices have slipped by a quarter in weeks, which offers “a buying opportunity”, as Timothy Puko points out in Barron’s.

The sell-off is an over-reaction to one of the warmest winters on record, which has dented demand in the short-term, but obscured an improving overall backdrop.

Output is declining after producers cut the number of rigs to historic lows last autumn, and liquefied natural gas exports are rising.

“Record demand from the power sector” – gas emits half the carbon dioxide of coal – is another bullish driver. Prices should soon bounce back.

Viewpoint

After his election, Donald Trump was cast by many as the reincarnation of Ronald Reagan. But things are different now, as a report from Oxford Economics points out. “The prospects for dollar gains on a similar scale to the 1980s look thin,” the report says. “The dollar was weak in 1980 but has seen strong gains since 2014 and may be moderately overvalued. And while we think the dollar is more sensitive to small rises in rate [differences with other economies] than previously, that sensitivity cuts both ways and quite a lot is arguably already priced into markets in terms of Fed rate hikes. So we expect dollar gains from here to be modest.”

Phillip Inman, The Observer