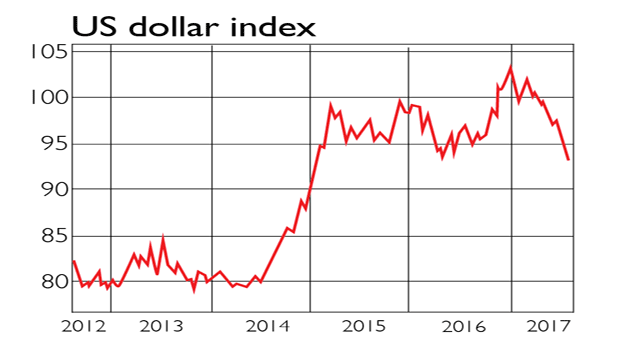

US stockmarkets might be performing well, but the same cannot be said for America’s currency. The US dollar index (which measures the dollar’s value against a basket of the currencies of its main trading partners – see chart) slid 2.9% last month, its fifth losing month in a row. That’s its longest losing streak since 2011. It’s a far cry from January, when the dollar index was sitting at a 14-year high. Then, notes John Authers in the Financial Times, an irritated Donald Trump bemoaned (via Twitter) the impact on US exporters.

Since then, the president has got his wish: the trade-weighted dollar has dropped 10%, a change “as effective as a tariff” in terms of making imports more expensive, and US exports more competitive.

The dollar is going to remain weak, precisely because Trump wants it to, argues Douglas Borthwick for TheStreet. “After all, a weak dollar is one policy that doesn’t need court or congressional approval. Instead, Trump can orchestrate it simply through tweets, media interviews and tough trade talk.” Many in the currency markets believe the dollar is due a rebound. But they’re wrong, says Borthwick. The euro is a particularly important component of the dollar index, and with eurozone fears subsiding (see page 4), the single currency’s rally should continue. “We’re not at a low for the dollar… this is merely the beginning.”

Fundamentals – such as central-bank policy, US bond yields, and economic strength – suggest the dollar should bounce back in the longer run, notes Authers. And yet, “in the short term it looks as though any bet on the dollar is a bet on US internal politics, and hence in part on the temperament of Trump. Few want to make such a bet.”