Anyone travelling to the continent from the UK this summer will have, no doubt, winced every time they’ve had to pay for anything.

The euro has been strong – surprisingly so – while the pound (and the US dollar) have been weak.

Today, I want to consider the euro against the pound. We could be close to an inflection point.

The euro’s relentless rise

US president Donald Trump has been criticised for many things, not least his apparent repeated failure to get any of his changes – from healthcare to tax reform – properly implemented.

But he has been extremely successful in achieving one of his stated goals: a weaker US dollar.

Whether he can actually take the credit for that or not is another matter. But the US dollar is down by some 15% this year against the euro, which has done very little else this year but surge.

People always seem to like to know why a market has done what it’s done. An easy explanation for euro strength is the perception that the European Central Bank (ECB) is set to rein in its quantitative easing (QE) programme at some point soon.

That may or may not be the case. In fact, the euro was not particularly strong against sterling in the first five months of the year. So it seems that this surge was, at first, more a matter of US dollar weakness than anything else. By late April, sterling was actually up against the euro on the year.

What did for sterling was the disastrous (if you’re Theresa May) general election. One euro could be exchanged for 83p in late April. It doesn’t seem that unreasonable a price now, although bear in mind that once upon a time in 2000, a euro would fetch you a mere 57p.

Today one euro is almost 92p. Parity, it seems, beckons.

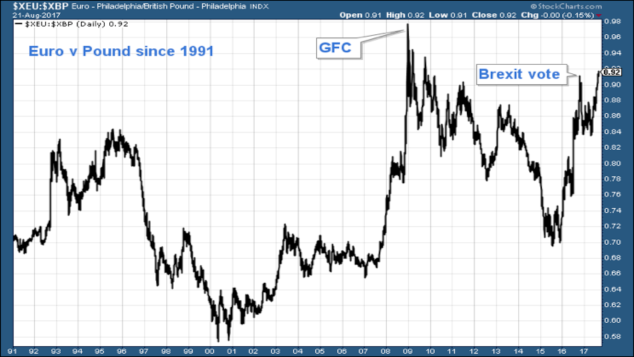

Let’s take a look at a long-term chart so we can see where we are in the grand scheme of things. Here is the euro against the pound since its inception in 1991.

On an intraday basis, the euro went to 98p at the height of the financial crisis in November 2008. So 98p is – as far as this forex pair is concerned – the final frontier.

The next big line in the sand, I would say, is 94p. We got there in spring 2009, and we also touched that level on an intraday basis during the peak post-Brexit pound panic in autumn last year, when we got the so-called Flash Crash.

After that I would say 90p is the next pivotal figure – it’s been a point of resistance and support in the past – although this month the euro breezed through that level like it wasn’t there on its way to its current price just shy of 92p.

So the euro is now a penny or two off the extremities of the Flash Crash of 7 October 2016. It’s just 6p from the extremities of the 2008 financial crisis. That is how far things have come. Those levels were panic extremes. This time around it’s been more gradual.

Here’s the euro against the pound over the last three years, for some more recent perspective.

My view is pretty basic: the euro is overvalued. The pound is cheap.

Such is the strength of the two currencies Britain’s economy is now smaller than France’s. Can you imagine the shame? Together with these latest ideas being touted about to tear down their statues, our ancestors must be turning in their graves.

How low can the pound go?

Anyway, according to analyst Charles Ekins, CIO at quantitative investment research and investment management boutique Ekins Guinness,

the euro is over-valued against the pound by 9%. In an email he tells me: “The strong euro is only 9% expensive against GBP which is still modest compared to its 23% overvaluation in late 2008 when EUR/GBP reached 1.02 (98p).”

Charles estimates that purchasing power parity (PPP) – ie, fair value – would be around 82-83p (although in late 2008, that figure would have been around 74p).

My instinct is that, despite these high valuations, we are not quite yet at the high and that this rally is not quite done. Trends often defy “sensible” thought – if you can call mine that – and right now the euro is in a strong uptrend.

The ECB next meets, I understand, in early September, so perhaps something will be attempted then to stem the tide – if not before, when ECB boss Mario Draghi appears at the central banker jamboree in Jackson Hole later this week. I’m not sure a strong euro will be deemed that desirable a thing across Europe in this age of competitive devaluation.

Despite what you might read on Twitter, Britain is not falling apart. Our government may be insecure. We have too much debt, for sure. But the stock market is strong. Unemployment is low. Business is pretty good. And the argument could easily be made that, despite the political insecurity, Britain is actually in better shape than many countries in Europe.

So, my view is also that an opportunity is brewing. Perhaps 94p will be the turning point. Or perhaps we need to go back to 98p.

That said, on a PPP basis, if things were to get as over-valued as they were in late 2008, and Charles Ekins is correct that PPP then was 74p, then perhaps we have a final target beyond parity at somewhere like £1.10 to €1.

I find that most unlikely, but you never know.

My view is that somewhere in the not-too-distant future, long-sterling, short-euro is going to be the trade.

Indeed, I’ve already taken a small position, and I’m underwater. I’ll be considering adding if we get to 94p or 98p, or even at parity if we get there. But I’m willing to wait.

Since late 2016, long-sterling, short-euro has been what they call a “widow-maker”.

I don’t quite know what the reverse of that is, but I’m hoping this turns out to be my “school-fees-payer” in the next academic year.