Today we consider the metal of kings and gods.

Prized by dragons and by dwarves, by giants and by leprechauns, by alchemists and explorers.

Eternal and incorruptible. Beautiful and true.

Gold…

The uses and abuses of cycles

Kondratiev waves; the four-year presidential cycle in US stocks; Frisby’s Flux – these are just some of the cycles talked about in the world of finance.

The problem I have with cycles is that they can be utterly compelling when looked at with hindsight. You look at historical charts, find an arbitrary pattern and declare it a cycle. They also make a good subject for copy.

But in real time, they are a much harder to beast to trade.

We know now that 1993 was a cyclical low in property; that 2000 was a cyclical high in stocks; that 2007-08 was a cyclical high in energy and base metals. If only we’d known at the time! We’d all be billionaires.

So when I talk about cycles – and I was doing so only yesterday – bear in mind that I do so with a great deal of cynicism.

That said, I find cycles to be extremely useful tools to help frame where we are in the grand scheme of things. It’s obvious that with stocks, for example, we are fairly late in the cycle, whatever that means – we just don’t how late. The interest-rate cycle, if there is such a thing, appears to have turned as well.

In my own life, I am just entering the golden age. At least, that’s what I keep telling myself.

So, to gold. I must say I feel a bit more bullish about gold than I have for a while. It’s not just because it’s had a pretty strong last month or so. I just feel like it’s kind of due a good run.

I’m not a full-blown bull – I’m just not as cynical and bearish as I was three or four years ago. “Gently positive”, you might call me.

I can see loads of parallels between now and 2000 – with cryptocurrencies today being what dotcom was then. We don’t know what the impact of crypto bursting is going to be, because so much of it is off-piste, and we don’t know when it’s going to burst. But I dare say it isn’t going to be pretty.

Just as dotcom was peaking, so commodities were coming to the end of multi-year bear markets, and all the disinflation of the 1980s and 1990s was morphing into a more inflationary 2000s, particularly with the rate cuts and liquidity infusions that followed the dotcom crash. We won’t get rate cuts when crypto bursts, but we’re bound to get some kind of panic.

Gold, meanwhile – people have lost interest. It’s all about bitcoin. The dashed hopes and dreams of the 2001-2011 bull market have had time to be forgotten. They’re just not as present in people’s minds as they were five or six years ago.

I think it’ll be a while before a lot of the mining BS that got spouted during that period will be believed again, but those peddlers are all in marijuana and blockchain tech companies now. A rising gold price could give birth to a new generation of potential peddlers and believers – but we are still a few years from that.

To me, it just feels like the stars are starting to line up for gold – better than they have for some time. I can’t help feeling gold will be an eventual beneficiary of crypto bursting.

I’m not convinced we are quite there yet, by the way. I don’t think this is 2001 yet (the multi-year low and the buy point of a lifetime), but you could say this is 2000.

Perhaps, just as in 2001 gold went back and tested its 1999 lows before setting off on a decade-long run, gold needs to revisit its 2015 low of $1,050. Who knows?

But looking out on the horizon there are a lot of potentially gold-positive things floating about in the distance: crypto bursting, a sovereign debt crisis, inflation, rising rates, monetary stress.

What’s next for gold?

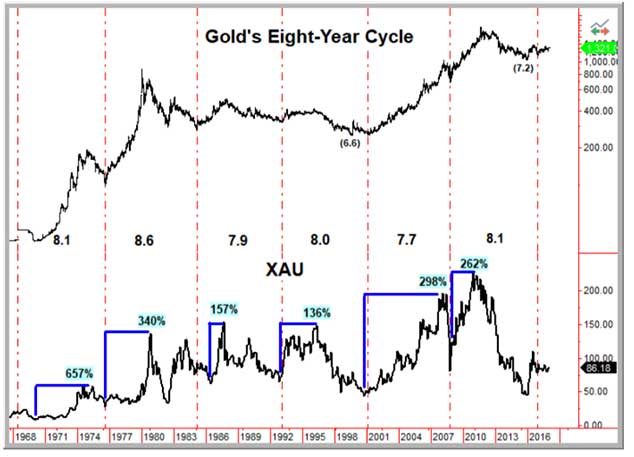

Yesterday I had an email from technical analyst Ross Clark (who is a great technical analyst by the way) over at Institutional Advisors in Canada reminding me of the eight-year cycle in gold. Here’s the chart he put together. It shows gold and beneath it the XAU, the index of large gold miners.

The argument is that roughly every eight years, gold puts in a tradable low.

Roughly speaking, the eight-year lows would be, going back in time: 2016, 2008, 2000, 1992, 1984, 1975, and 1967. These were all reasonable entry points.

Ross says: “After an initial surge off the cycle lows, the price tends to move methodically higher for the first two years”. But somewhere between 54 and 64 weeks off the low, you get an interim correction.

We’re currently 55 weeks off the December 2016 low, so we are in the time frame for an interim high, in which, all being well, we might expect a pullback. That pullback would represent an ideal entry point into the sector.

Like I say, cycles look a lot better in the rear view mirror. But gold’s had a great little run. A small pullback would be no surprise, or at least some consolidation. That would tie in with Ross’s analysis.

But one, two or three years away – that’s when all those dangerous ships floating out on the horizon could sail into port. And that’s when you’ll want to have plenty of gold already locked up in your vaults.