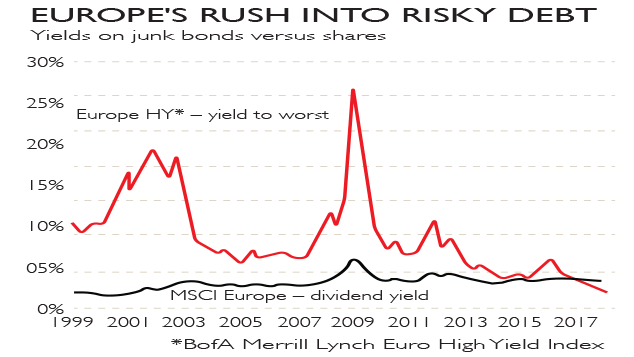

It feels like 1998, says John Authers on the Financial Times website. A sign of irrational exuberance is the rush into risky assets in Europe. The yield on a widely watched index of European junk bonds has hit record lows (reflecting soaring prices), slipping below the dividend yield on the MSCI Europe equity index.

This is absurd since corporate debt is historically overpriced, and equities offer scope for capital gains and income growth. The European Central Bank has been buying investment-grade corporate paper since 2016, fuelling the dash for yield and overall bullishness in the market.

Viewpoint

”Britain has achieved many things over the past 50 years. But few can match not building a third runway at Heathrow. We’ve been at it since 1968 [yet] Heathrow still doesn’t even know where to put its new runway. The best it can offer is three options… Moreover, that’s just the most glaring key fact missing from Heathrow’s latest consultation paper… so many crucial details are still up in the air that it’s hard to spot what the ten-week consultation is consulting on… Apart from the multiple-choice runway location, there are three possible sites for a new terminal, a smorgasbord of potential taxiways and some gobbledegook about ‘realigning’ the M25.”

Alistair Osborne, The Times