If only…

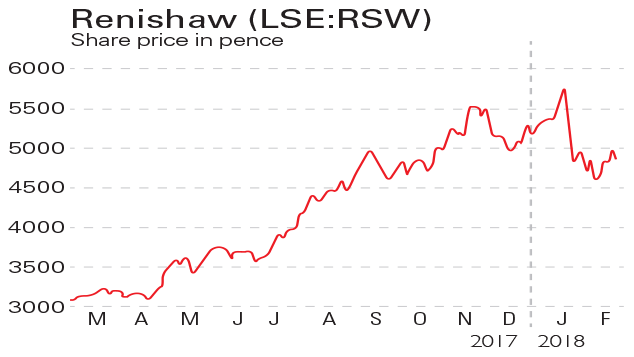

Renishaw (LSE:RSW) develops and sells high-technology precision measuring and calibration equipment. Over the past 12 months, it almost doubled its market value as results continue to impress. Revenues jumped 17% to £279.5m, while adjusted pre-tax profit leapt 72% higher to £62.3m. It now expects full-year revenues to cross the £600m mark for the first time. However, the shares slipped back in January when David McMurtry – the firm’s founder, largest shareholder, chairman and chief executive – announced he was stepping down as chief executive.

Be glad you didn’t

GlaxoSmithKline (LSE:GSK) is Britain’s biggest drugmaker. Last July the company said it would offload more than 130 of its non-core brands as it extended a restructuring programme meant to deliver £1bn in annual cost savings by 2020. In October, the chief executive, Emma Walmsley – who took over last April – announced a 4% rise in third-quarter sales to £7.8bn, helped by demand for new HIV, lung and meningitis products. Operating profit rose 31% to £1.9bn. But investors remain sceptical about the sustainability of the firm’s dividend and the shares slid further.