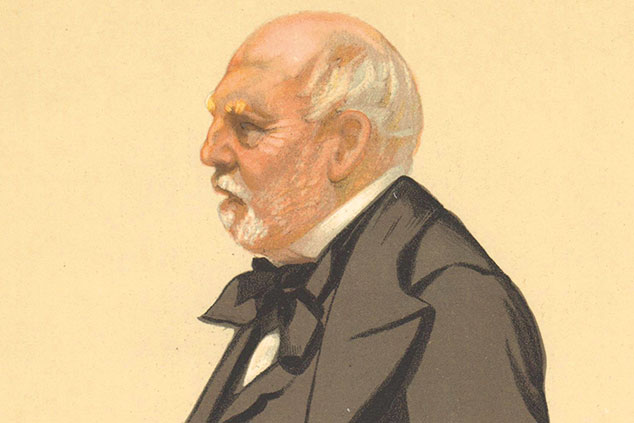

Sir Philip Rose was born in 1816, the son of a British army officer. He qualified as a solicitor at the age of 20 and was partner in the law firm Baxter, Rose, Norton & Co. (now Norton Rose) until 1872. A financial adviser to Benjamin Disraeli (UK prime minister from 1874 to 1880), he set up the Foreign and Colonial Government Trust (now the Foreign and Colonial Investment Trust) in 1868, with Samuel Laing, James Mackenzie and Lord Westbury. While the trustees managed the fund collectively until 1924, Rose was acknowledged as its driving force, and was a trustee until he died in 1883.

What was his strategy?

The trust was set up “to give the investor of moderate means the same advantages as the large capitalists… by spreading the investment over a number of different stocks [bonds]”. In practice, this meant buying a portfolio of ten to 15 foreign government bonds in the hope of earning a yield greater than the interest rate available on UK government bonds. The five largest holdings, accounting for half of the portfolio, were Spain, Turkey, Italy, Peru and Russia, all viewed at the time as risky markets (plus ça change, you might well think).

Calculating returns is made harder by the fact that, before it listed in 1879, Foreign and Colonial was structured as multiple funds, some of which used a lottery to determine returns to investors. However, historians think that returns for those who invested in 1868 and stayed in for the first decade were 6.5% a year, well above the 3.5% from gilts. Between 1868 and 2017, its assets grew from an initial £500,000 to £3.7bn.

What were his biggest successes?

Probably the most successful investment was in Turkish bonds, which were trading at around half their par value, giving an effective interest rate of 15% a year. Overall, nearly all of the bonds the trust bought met their payments, although the Spanish bonds were restructured, giving a capital loss of around 50%.

What can investors learn?

Diversification and seeking higher returns by investing in riskier markets are now standard practice, but at the time it was considered revolutionary. It’s also worth noting that, despite its strong returns, the trust worked hard to keep costs as low as possible for investors, charging an annual fee of only 0.5% (far lower than what most active funds charge today).