If only…

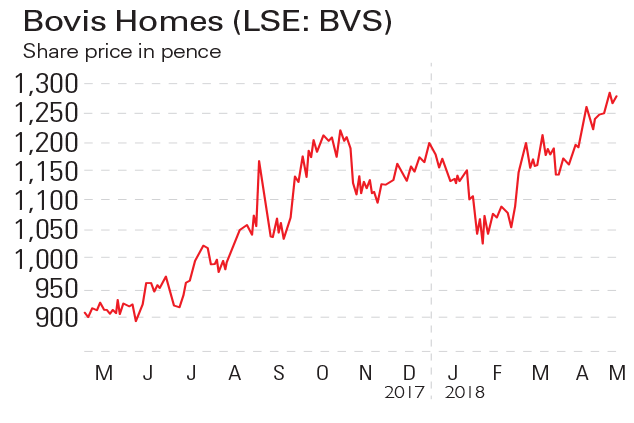

Bovis Homes (LSE: BVS) operates three regional housebuilding businesses in the UK. Shares of the firm, which fought off a bid from rival Galliford Try last April, have risen by roughly 40% in the past year. In March, Bovis reported results for 2017 during which turnover fell by 3% to £1.03bn, despite a 7% increase in the average selling price to £272,400 from £254,900 the year before. Pre-tax profit met expectations at £124.3m, down from £154.7m in 2016. However, the firm also ended the year with a net cash balance of £145m, up from £38.6m a year earlier.

Be glad you didn’t buy

Crest Nicholson (LSE: CRST) develops sustainable housing and mixed-use communities. Its shares have declined by roughly 20% over the past year. This is despite reporting solid results in January for the year to 31 October 2017, during which sales were up 7% to £1.1bn. It also posted a 5% rise in revenues, from £997m to £1bn, as well as a 6% rise in pre-tax profits, from £207m to £195m. The results were boosted by demand for new homes being underpinned by rising employment and low interest rates. The shares currently yield 7%.