Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

If you missed any of this week’s Money Mornings, here are the links you need.

Monday: A very simple investment tip that you should never forget

Tuesday: Italy is not this year’s problem – but it could be a big deal in 2019

Wednesday: The oil price is going to keep rising – here’s how to profit

Thursday: This could be the end of the longest-running trend in your financial lifetime

Friday: Ocado’s surge shows what happens when a hated asset springs a surprise

Now over to this week’s charts.

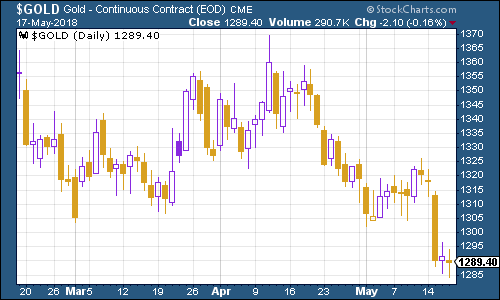

Gold finally cracked. It’s fallen below $1,300 an ounce, which was a bit of a technical line in the sand. What gives?

Well, let’s see. A lack of risk aversion for a start – no one wants something boring like gold when the economy looks so strong. Also, gold just hasn’t been going up. Other stuff is going up. And fear of inflation hasn’t hit the point where the concern is about damaging inflation – instead, there’s still that hope that things are heating up and there’s plenty of money to be made elsewhere.

More explicitly, this week US Treasury yields have gone up. As US rates go up, the US becomes a more appealing investment destination (because you can get a bigger return on your money). That attracts dollars, and so the dollar price goes up.

Anyway, this is why you have some gold in your portfolio. It’s not something people want in good times. It’s something they turn to in bad. You can’t predict when either of those will be in the ascendant. So it’s worth having a bit, just in case.

(Gold: three months)

The US dollar index – a measure of the strength of the dollar against a basket of the currencies of its major trading partners – rallied again as economic data took a turn for the punchier again. Economic survey data shows that business is strong, but also that cost pressures are rising fast.

The Philadelphia Fed manufacturing index, for example, jumped to its highest level in a year. Meanwhile, the “new orders” measure hit its highest level since 1973, while the cost inflation index was at its highest level since 1989.

(DXY: three months)

The yield on the ten-year US Treasury bond rose above the 3.11% mark this week. As I said in Money Morning the other day, This could be the end of the longest-running trend in your financial lifetime. Various analysts are growing more confident that this is it for the bond bull market.

(Ten-year US Treasury: three months)

The yield on the ten-year German bund – the borrowing cost of Germany’s government, which is Europe’s “risk-free” rate – headed higher too.

In Europe of course, Italy is causing some concerns – the new populist coalition is making some rebellious noises about the EU’s ‘guidelines’ on public spending. Will this amount to anything? My gut feeling, as I said Italy is not this year’s problem – but it could be a big deal in 2019, is: ‘not yet’.

However, the idea of producing a form of parallel currency, could be sewing the seeds for those future problems. We’ll take a look at that in more detail next week.

(Ten-year bund yield: three months)

A lid has remained on the copper price, mainly due to the strong dollar.

(Copper: three months)

Bitcoin had another reasonably calm, if downward-trending week.

(Bitcoin: ten days)

On US employment, the four-week moving average of weekly US jobless claims hit another fresh low for the cycle of 213,250 this week, while weekly claims came in at just 222,000.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a “cyclical trough” (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later.

So we’ve just hit another new trough, so if there’s anything to Rosenberg’s observations (and of course, they are drawn from a limited pool of past cycles), then we should see the stockmarket hit new highs before this cycle is out. That would mean the S&P 500 returning to close to 2,900. It’s certainly feasible.

(US jobless claims, four-week moving average: since January 2016)

The oil price (as measured by Brent crude, the international/European benchmark) isn’t stopping. My colleague Dominic Frisby has long referred to this as a The oil price is going to keep rising – here’s how to profit, and he’s been right on that. But I think investors are clearly starting to wake up to it.

My colleague Matthew Partridge spoke to Richard Hulf of Artemis Global Energy to get his take on the oil market and the best stocks to play it.

(Brent crude oil: three months)

Internet giant Amazon continued on its merry way. Perhaps the most interesting news on this front this week was that Walmart’s online adventures are continuing to go well – online sales in the US surged by 33% in the quarter to the end of April. The supermarket giant is probably Amazon’s biggest potential challenger in the US.

(Amazon: three months)

Tesla saw its share price ease off this week. The usual concerns are still hanging over the electric car group – does Elon Musk have his eye on the ball? How much money will Tesla need to raise and when? Will it ever manage to ramp up production of its Model 3s?

(Tesla: three months)