Investors in Biogen (Nasdaq: BIIB) won’t forget Friday 6 July in a hurry. The shares bounced by almost a fifth to $357 after the company announced that a highly promising new treatment for Alzheimer’s disease(BAN2401) had cleared a key regulatory hurdle.

Biogen is one of the largest US biotech companies, specialising in treatments for neurological diseases such as multiple sclerosis (MS), Parkinson’s and Alzheimer’s. The latter is the sixth-biggest killer of over-65s in the US. Around 44 million people worldwide live with Alzheimer’s and other forms of dementia, while research suggests that just one in four people with Alzheimer’s have actually been diagnosed.

Despite the urgent medical need, no new drugs have been approved for Alzheimer’s for 15 years. Existing drugs do little more than mask early symptoms so a new drug could command super-blockbuster peak sales of up to $20bn per year. To put this in perspective, Biogen’s 2017 revenue was $12.3bn. No wonder the market was excited.

Passing the next test

Nonetheless, BAN2401 still has some way to go before it fulfils its early promise. It has just successfully completed the Phase II stage of clinical trials, and needs to pass through Phase III before the US Federal Drug Administration regulator will consider whether or not to approve it.

Only a small percentage of all drugs make it to the third stage, the most extensive part of the clinical-trial process in which the treatment is typically tested on larger groups, its effectiveness is probed in more detail, and any side-effects are considered.

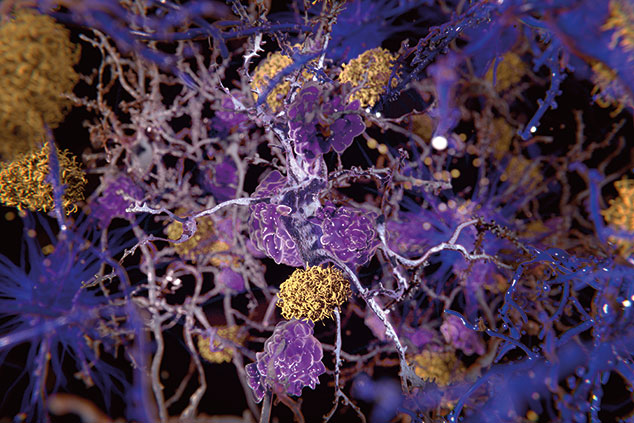

Several promising Alzheimer’s drugs from other companies have failed during Phase III trials. But Biogen’s Phase II trial is auspicious for four reasons. Firstly, it involved a substantial number of patients (856) with mild Alzheimer’s in a proper placebo-controlled double-blind trial for 18 months. Secondly, the patients all had amyloid plaques in the brain. These are associated with Alzheimer’s and there was a clear reduction in these plaques after treatment with BAN2401 for 18 months. Indeed, at the highest dose, 81% of patients had converted from amyloid-positive to amyloid-negative at 18 months.

Thirdly, the reduction in amyloid plaques was accompanied by significant slowing of cognitive decline. Finally, and crucially, both the reduction in plaques and the slowing of cognitive decline were dose-dependent, with more effect visible for higher doses of BAN2401. Dr Jeff Cummings, founding director of the Cleveland Clinic for Brain Health said, “The 18-month results of the BAN2401 trial are impressive and provide important support for the amyloid hypothesis.”

More pills in the cupboard

BAN2401 is not Biogen’s only pipeline Alzheimer’s drug. It has two other drugs in Phase III trials (aducanumab and E2609) and three more in Phase I. Biogen’s partners in the development of BAN2401 are Eisai, the Japanese drug company, and a small Swedish biotech called BioArctic.

Biogen has many other drugs on the market. Its main product line is MS drugs, where it is world leader – its five MS drugs accounted for 87% of 2017 product revenues. In addition to the six Alzheimer’s drugs, the pipeline contains two further MS drugs, along with treatments for lupus, Parkinson’s, stroke, epilepsy, schizophrenia and other conditions.

So there is a strong core business, while the Alzheimer’s and other pipeline drugs are potentially lucrative additions to the product range, especially if at least one is approved for Alzheimer’s. Biogen’s share price has stayed high since early July, so investors clearly remain optimistic about BAN2401’s chance of surviving Phase III trials. (I hold shares in Biogen.)

A fast grower with a promising future

Biogen is one of the top US biotech companies with 2017 sales of $12.3bn. Care needs to be taken comparing its 2017 results with those of 2016 since its haemophilia business was spun off as a separate listed company, Bioverativ, in February 2017.

Most of Biogen’s current revenue comes from its MS drugs, but its new drug for spinal muscular atrophy (Spinraza) is quickly establishing a foothold. Revenues reached $884m in 2017 and $423m in the second quarter of 2018. The core growth pipeline contains drugs for Alzheimer’s and other neurological conditions, and there is an emerging growth pipeline in areas such as stroke, ophthalmology and pain.

ratio

The table shows that underlying revenue growth (eliminating Bioverativ) from 2016 to 2017 was 15%. The increase in non-GAAP earnings-per-share (EPS) was 8%. Non-GAAP EPS differs from the GAAP version in that the former is adjusted to eliminate a one-off charge on repatriated earnings of $1.2bn in 2017, a result of the US corporate tax reform.

Biogen shares are down very slightly from their peak on 6 July to show an 18.5% gain from 5 July. In the second quarter of 2018, revenue climbed by 9% to $3.4bn and non-GAAP EPS by 15% to $5.80. Given the competition in MS drugs, the upside potential of Biogen as an investment lies in its neurological pipeline – particularly the drugs for Alzheimer’s. The key risk is a Phase III clinical-trial failure for one or more of the three late-stage Alzheimer’s treatments.