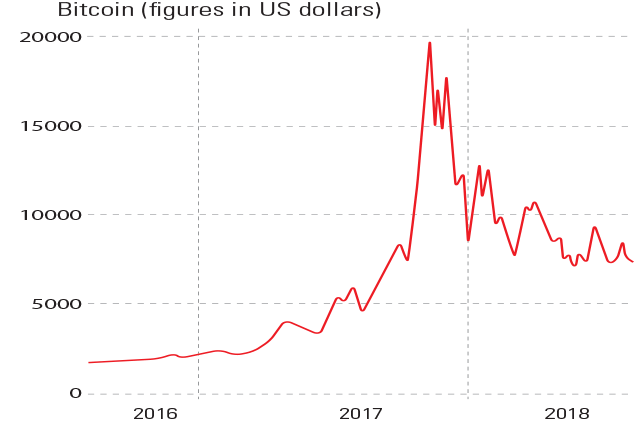

Last week bitcoin dropped by more than 20% in a few days to around $6,200 before recovering slightly. Other cryptocurrencies such as ethereum and XRP have lost their footing too. Negative publicity appears partly responsible for the latest slide: there have been reports of a large sale of bitcoins relating to possible drug sales on the dark web.

Meanwhile, a report claiming that Goldman Sachs has abandoned plans to open a bitcoin trading desk won’t have helped. The US Securities and Exchange Commission has rejected proposals for bitcoin ETFs owing to their lack of transparency. Finally, a strong dollar has reminded investors increasingly disenchanted with cryptocurrencies’ volatility of the benefits of a robust reserve currency.

Viewpoint

“A shrewd observer of London’s after-work drinking culture once [said]: ‘There is no number between two and six.’…After a third drink, another will seem like a good idea – and another, and another…[This applies] to Italy’s bond market. As long as yields are two-point-something or lower, they are sustainable… As yields rise above 3%, they may become unmoored… The stability of public finances is in question. Yields might plausibly spike to 6% or more… At least you are getting a higher yield in return for the risks. You are paid for your discomfort. That is not true of French bonds, which trade at only a small premium to Germany’s. Think of the eurozone bond market as an after-work drinks party. Germany dislikes buying drinks for others, and so has gone home. Italy is on its third trip to the bar. France, which is nursing its first drink, insists that it is leaving soon. But if a fight breaks out, it will get drawn in.”

Buttonwood, The Economist