If only…

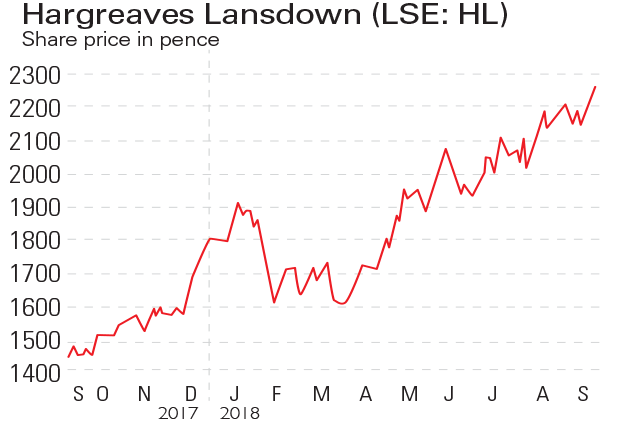

Hargreaves Lansdown (LSE: HL) is the UK’s biggest investment platform, with over £90bn under management on behalf of more than a million customers. Over 130,000 new customers brought in net new business of £7.6bn in the year to 30 June, driving pre-tax profits up by 10% to £292m. Some of the increase is due to transfers relating to what Hargreaves termed “operational issues on competitor platforms”: the fallout from Barclays Stockbrokers’ botched new broker service Smart Investor. Hargreaves Lansdown’s share price has risen by almost 60% in a year.

Be glad you didn’t…

Alfa Financial Software (LSE: ALFA) provides software for the financial services industry and made its debut on the London stockmarket in May 2017. Shares initially jumped by 32% and by the end of 2017 the company’s value had risen to £1.6bn. But 2018 has not been kind to Alfa. The strength of the US dollar and delays in some major contracts led to a fall in sales. And despite what the CEO calls a “healthy pipeline”, two profit warnings did further damage to the share price, which is now down by 70% in the last year. Alfa could fall out of the FTSE 250.