Welcome back. We have a new podcast for you this week (yes – that’s two weeks in a row now!) – Merryn and I talk about house prices, gold miners, inflation and fiat money. All of our favourite topics squeezed into just 15 minutes of chat. Have a listen if a new podcast for you.

If you missed any of this week’s Money Mornings, here are the links you need.

Monday: Not invested in Japan yet? Now looks a good opportunity

Tuesday: We’ve just seen the biggest merger deal in gold mining history

Wednesday: Is oil heading for $100 a barrel? Or will Trump throw a spanner in the works?

Thursday: How on earth are we going to get rid of all of this debt?

Friday: We’ve spent our entire lives in a massive economic anomaly

Be sure to check out Merryn’s feature on value and momentum investing, or Matthew Partridge’s interview with a short-seller.

And don’t miss this week’s issue of MoneyWeek magazine (particularly if you’re interested in what’s next for UK house prices). If you’re not already a subscriber, sign up here now.

And now over to the charts.

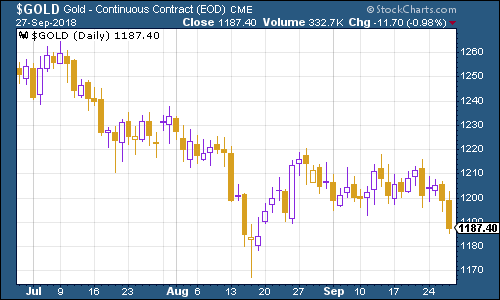

Gold (measured in dollar terms) had another mediocre week. There are many reasons to think that gold should go higher in the short term – speculators are very short on gold, and We’ve just seen the biggest merger deal in gold mining history does suggest to me, at least, that the sector is truly detested right now.

However, the US dollar has enjoyed a big rebound this week and the Federal Reserve still has investors convinced that it’ll continue to raise interest rates and tackle inflation. That’s never going to be good news for gold, which is why it continued to struggle this week.

(Gold: three months)

The US dollar index – a measure of the strength of the dollar against a basket of the currencies of its major trading partners – rebounded sharply this week. The Fed raised interest rates this week – which was entirely expected – but Fed boss Jerome Powell also seemed pretty determined to keep on hiking.

It didn’t help that fears over Italy’s rather intransigent budget – more on that in a moment – rattled the euro (a big part of the US dollar index basket).

(DXY: three months)

The yield on the ten-year US Treasury bond was little changed on last week, but it has remained above the 3% mark.

(Ten-year US Treasury yield: three months)

The Japanese government bond (JGB) yield is still edging higher above the 0.1% level after the Bank of Japan’s recent decision to let it move around a little more.

(Ten-year Japanese government bond yield: three months)

But the action in bond markets this week was mainly in Europe. The yield on the ten-year German bund (the borrowing cost of Germany’s government, Europe’s “risk-free” rate) has continued to rise, narrowing the gap with US yields ever so slightly. But the gap between German and Italian bonds widened as the Italian government agreed a budget that will see Italy run a larger-than-expected deficit for the next three years. That’s not what Brussels wanted to see and the increased chance of friction hit the euro hard too.

(Ten-year bund yield: three months)

Copper still appears to be in recovery mode – my tentative sense that it had hit a bottom is looking like it has more and more chance of proving correct. That’s interesting given that the US and China are still at loggerheads on the trade front. You’d expect that to be bad news for growth, and therefore, copper (which is used in just about everything a growing economy needs).

Yet as Reuters points out, stocks of copper held within the London Metal Exchange warehouse system have been falling and are now back at levels last seen in January. Also, China imported a record amount of raw copper in August this year. “If there’s a China-led global slowdown in copper usage coming, it seems no one has told the country’s copper sector.”

(Copper: three months)

Cryptocurrency bitcoin had a strikingly uneventful week. It hit a low at one point of around $6,100, a high of about $6,900, and ended the week somewhere in the middle. By bitcoin standards, a weekly range of less than 20% looks impressively unvolatile.

(Bitcoin: three months)

On US employment, the four-week moving average of weekly US jobless claims stayed close to its cycle low this week. It came in at 206,250. Meanwhile weekly claims rose to 214,000, partly because of disruption from Hurricane Florence pushing some claims from last week (which was unusually low) into this week (which was higher than expected).

As David Rosenberg of Gluskin Sheff has noted in the past, the stockmarket usually does not hit its peak until after we’ve seen jobless claims (as measured by the 14-week moving average) hit rock bottom for a cycle.

In other words, jobless claims hitting a cyclical trough and then starting to turn up is a lead indicator for a stockmarket peak. Based on a very small number of widely varied observations, the stockmarket peak usually follows about 14 weeks from when jobless claims hit the bottom, and a recession follows about a year later.

In other words, we should be a while away from a peak and recession as yet. But watch out for an upturn.

(US jobless claims, four-week moving average: since January 2016)

The oil price (as measured by Brent crude, the international/European benchmark) is now above $80 a barrel which we haven’t seen since 2014 (which, as you may remember, was the year of the most recent oil price crash). Now we’ve got people talking about $100 a barrel again. Is that likely? I looked at the issue in more detail in Money Morning this week – Is oil heading for $100 a barrel? Or will Trump throw a spanner in the works?you missed it.

(Brent crude oil: three months)

Internet giant Amazon continues to be the one stock that no one feels nervous about owning. Here’s the latest analyst forecast – Jefferies analyst Brent Thill reckons the price could hit $3,000 a share within two years.

I mean – I don’t know how you argue with that. It’s pure extrapolation (bear in mind that Amazon’s share price has more than doubled in the past year) and the fact that someone is happy making these forecasts with a straight face shows just how invincible people feel Amazon is.

As I always say – it’s a great company and I’d be happy to have exposure to it via a decent tech fund (Scottish Mortgage investment trust being the prime example). And I know my own flaws as an investor – I tend towards the bearish and value-oriented and that means I’m never going to be a big fan of tech stocks, so it’s best for me to hedge proactively against my own instincts by owning that sort of fund.

But I also can’t help but think that the psychology points to markets being far too convinced that Amazon can do no wrong.

Of course, the catalyst to change that could be a long way off.

(Amazon: three months)

Electric car group Tesla had been in full-on recovery mode this week, as you can see from the chart, which ends at the close of play on Thursday. However, then the US regulator, the SEC, decided to file a lawsuit against Elon Musk, over his tweets early last month that declared he had secured funding to take the carmaker private. So the shares had much more of a rollercoaster ride on Friday.

Meanwhile, the carmaker updates on production and delivery of Model 3s in the third quarter next week. The hope is that it can turn cash flow positive – in other words, stop burning money – and also demonstrate that it can actually produce enough of its cars to be a viable company.

Those figures have suddenly become a lot more important – I suspect that much of Tesla’s valuation has relied on an unshakeable faith in Musk. The company now has to show that it can stand on its own, with or without him. I wonder if it can.

(Tesla: three months)

Have a great weekend. And don’t forget a new podcast for you.