Cinema chains have had a rough decade. Audiences have stagnated as people watch fewer films on the large screen and concentrate on television instead. There is constant pressure from studios either to shorten or scrap the 90-day window between a film’s cinema release and its launch on streaming services (known as premium video on demand). Some streaming services, such as Amazon and Netflix, are even trying to get studios to skip a cinema release entirely and go straight to TV instead.

Nevertheless, the sector is hardly a write-off. While there has been a modest per-capita decline in the number of people attending cinemas, it is relatively limited, amounting to less than 1% a year per person in the United States. And thanks to more expensive tickets, overall revenue is still growing.

What’s more, over the past year studios have backed away from accelerating film launches on premium video on demand after studies suggested this cannibalises rather than enhances revenue. Talk has shifted from eliminating the 90-day window to reducing it to 50 days, a recognition that a film’s success on the big screen drives secondary sales.

A resilient operator

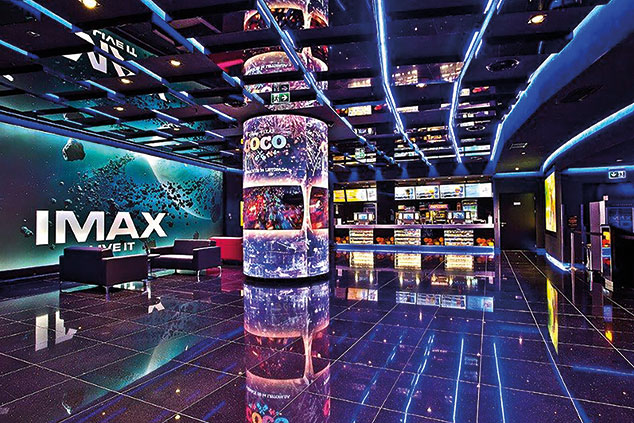

One cinema chain that has defied the tough backdrop is Cineworld. Its strategy has been to invest in the latest technology, such as the bigger IMAX screens and wall-to-wall Superscreens, on the basis that if you’re asking people to pay extra, you should give them something that isn’t available at home.

It has also had a lot of success selling monthly memberships that permit unlimited visits, while the Picturehouse chain of cinemas focusing on arthouse and independent productions has diversified its range of films. Cineworld has delivered strong growth, more than doubling revenue between 2013 and 2017 while maintaining strong margins.

Its UK success bodes well for the recent $3.6bn takeover of Regal cinemas, one of the largest chains in the United States. Over the past five years Regal’s market share has declined to around 20% (allowing plenty of room for expansion), and experts view its cinemas as outdated. Cinewold has pledged to turn Regal’s fortunes around by investing in a refurbishment programme. It will also attempt to increase non-ticket revenue by boosting the amount of food and drink on offer (this currently accounts for a third of sales).

Despite the group’s strong revenue growth and explosive share-price performance it trades at only 12.3 times forward earnings. Its 10% return on invested capital shows that it is squeezing value from the money that it puts into the business. Overall, we’d suggest buying Cineworld at its current price of 289p. We’d suggest that you buy it at £12 per 1p, compared with IG’s minimum of £1. We’d put the stop loss at 209p, which will give you maximum downside of £960.

How my tips have fared

The slight recovery in the value of the FTSE 350 over the last fortnight has bolstered our long positions,

with four out of the six stocks rising.

Greene King went up from 492p to 499p, Redrow rose to 558p from 500p, Shire is now at £45.57, up from £44.86. Next is at £51.96, compared with £50.51.

However, Premier Oil edged down from 109p to 107p, increasing our losses to £437.50, while Saga tumbled to 116p, down from 130p. Overall, Greene King and Shire are making money, while the rest of our long positions are in the red.

The bad news, however, is that while market conditions have boosted our longs, they have generally been bad for our shorts. With the exception of Netflix, which fell from $330 to $315, all the others went up in value.

In some cases, the rises were relatively minor, with bitcoin going up to $6,404 from $6,387, Snap increasing from $6.84 to $6.90, and Weis Markets also rising, from $44 to $44.60.

However, Tesla shot up from $261 to $341 after it shocked everybody by actually making a profit, thanks to income from carbon credits. Just Eat also jumped from 601p to 626p, while Twitter is now at $34.02.

Overall, while the losses on our longs have been reduced to £1,338, the profits on our shorts have shrunk to £1,392. This means our open positions are now just £54 in the black.

At present we have three open positions held for more than six months: Greene King, bitcoin and Tesla.

While we’d generally look to close any old positions that are making a loss, I’m going to give my Tesla short a reprieve – although if things don’t improve by the end of the year I’m definitely pulling the trigger. I’m also going to reduce the stop loss of bitcoin to $7,500.

Trading techniques: Dr Copper

Traders are always on the lookout for leading indicators that can provide advance warning of a recession and a downturn in the stockmarket. One of the most popular has always been the price of copper – or “Dr Copper” as it’s sometimes known. Because copper is needed for everything from batteries to the wiring inside houses and cars, if firms expect the economy to expand they will start to buy more copper in anticipation of increases in output. This will push prices higher. During an economic slowdown the process will go into reverse.

There is some evidence that copper consumption and global economic growth are linked.

For example, Tom Wise of the Bank of England found a strong correlation between growth in global copper consumption and worldwide economic growth between 1981 and 2016. He also found that between 1999 and 2017 there was generally a strong three-year rolling correlation between metals prices and various measures of world activity.

However, copper’s usefulness as a guide to the stockmarket, notably America’s, has declined. Both copper and the S&P 500 collapsed in the second half of 2008, before rallying in early 2009. However, between February 2011 and early 2016 copper prices fell by more than half, while the S&P 500 went steadily up by more than 53%. Part of the reason for this is that the biggest consumer of copper is now China, which accounted for nearly half of world consumption in 2017. The decline of American manufacturing means that US copper consumption is only two-thirds of its 1998 level.